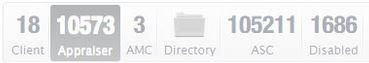

You should see the AMC and lender platforms from the other side. I have. They click appraisers away without a thought, all day, all night. Your star and other score ratings are not self contained to only one client like presumed. When working with AMC's, the blacklist effect is exponentialized across a broad spectrum of lenders whom also work with that AMC. A review of AMC networking with wholesale lenders reveals there is near total integration, how most lenders are currently or were in the past, networked with most AMC's out there. Additionally the tech tools are all coded in the lenders favor, they have every possible metric to consider you can imagine, including the most basic offenses such as always assign to the lowest fee appraiser. Meanwhile they purposefully do not allow appraisers any meaningful metrics such as how many other appraisers a request may have been sent to, what the borrowers fee was, if appraisers have availability, fair balance of over all order volume, the same old routine.

Not very much to worry about with old reports due to this historical low rate rush which captured the industry several years ago. You can safely presume that the vast majority of everything from the past was nullified by refinancing or sale efforts in the past five or six years. It's the volume based appraisers whom worked hard during the rush whom have the most to worry about now. They have no idea how much blowback might just come at them in the next few years.

What should get you worried is the incredible nature of ongoing predatory activity by lenders whom on one hand knowingly stack out risk with extremely delinquent borrowers, refinancing them without appraisers, without mb's, and without updated qualifications, at 115% LTV's with a maximum 1% rate cape increase, either writing down or tacking everything on the back end and resetting the loan term (customers for life!). This is how they keep the default and REO to absurdly low levels of less than one percent, despite the serious delinquency rate at 11% or higher. While on the other hand continuing to push fresh loans out there knowing that there is no legitimate price discovery and if honest market principals were to once again take hold, we'd all quickly learn the entire nations housing supply is overvalued at least a tenth, if not a fifth or more of the total 'current value'. The entire housing market is propped up as first purchase opportunities go to the investor class at pennies on the dollar, whom are not subjected to similar market conditions as regular buying/refinancing/renting citizens. Everything from rental to condo to average sf's, to jumbo, and especially manufactured, overvaluation across the board. This ties into the appraiser racism argument, as they needed someone to blame for this purposful with holding of 'generational wealth'. The policies which deny people affordable housing and keep people locked into upside down positions, while concealing their honest price discovery from them, those policies come right from the top. FHFA is now the new ring leader of this fraud.

Government complicity enables deadbeat borrowers, burdening housing market disconnect & artificially inflating home prices.

appraisersblogs.com

The real reason you get these stipulations is because of the unknowable (to you) nature of borrower qualification. When they're poorly qualified, the lending package is shored up with additional appraisal scrutiny. Because in those scenarios automatic underwriting approval is not permissible and is always sent for manual review. Then the UW is challenged on a quota based system to find something, anything, regardless if it's valid or not. This creates the situation where if liability occurs, there is a paper trail leading to the appraisers inadequate performance to dump that on your insurance. The grading system confirms this alleged fact regarding both your competency and performance. Where as with better qualified borrowers, they pass through without much ado. Not to fear, with the updated expansion of the waiver program that's all you be seeing if you're dealing with origination work; poorly qualified high risk borrowers with maximum loan leverage. As if the current situation of everything under 80% LTV being waved through was not bad enough. You ain't seen nothing yet.

If you're going to keep working, in this age of extra ordinary data cancer brought about by waivers, you should at least have read the FRB's final rule on AVM's.

Some of the comments were really something else, to say the least. Sadly this one went under the radar and very few did anything to stop this. I don't recall seeing any of your guys's or gal's name on those comment boards. And only a rare few of you participated in the comments about the algorythm.

www.regulations.gov

The comment period also provided a platform for individual appraisers to share their perspectives regarding appraisal fees & the role of AMCs

appraisersblogs.com

You know the difference between this site and the appraisers blogs? Regulators and policy makers actually read and subscribe to that website. There is so much noise here which is why if you want to make a difference, to need to take the time to chime in over there as well. The lady whom runs that used to spend over $700 a month out of her own pocket for many years to keep that site going and secure, constantly subjected to many technical issues as she refused to capitulate to censorship from industry interests. This site is fun and has value but when it comes to making a real difference, there is no comparison between the forum and the blogs. There is a clear winner in terms of driving policy and bringing the issues with the appraisal industry to the publics attention. Sadly the AF lost it's primary ability to be a voice for the appraiser community at the exact same time the GBU thread was placed behind a login wall. I'm not faulting the admin/owner, because certainly those were trying times and tough choices had to be made. But I am calling on the regulars here with a question; If you honestly believe in saving this industry, why don't you post there more, and write articles for that website to make a real difference? You can write articles anonymously, or attribute directly. You don't need FB accounts to participate, although the site is linked in to both FB and LnkdIn. Admin does at time pay for article advertisements to get some of them out there with a much broader reach. The view counts per article are really tremendous lately, although you would not know that just by open posting volumes, as most just lurk and read, but do not post. This is the final hours of this industry, so you know, if you actually cared about those of us whom are left here with not many other options except to right this ship or go down with it.