App3000

Freshman Member

- Joined

- Dec 23, 2016

- Professional Status

- Certified Residential Appraiser

- State

- Georgia

The current equation for determining the contributory value of a feature is incomplete.

This current equation comes from the depreciated cost method which is market value (m); equals the cost to build the improvements new (c); minus any depreciation (d); plus the cost of the site (s); or (m = c - d + s).

This equation has been modified to determine the contributory value of a feature, such as an In-ground pool, enclosed deck, flooring, upgraded kitchen, bathrooms, etc., by removing the site factor (s) since it no longer applies. Leaving the equation of (m = c - d).

However, this modification has left the equation incomplete as it only works part of the time.

The correction to the equation is to add for (r) or return-on-investment (ROI), which can be a positive or a negative value.

The complete and correct equation is (m = c - d + r).

The reason the current equation would work part of the time is when the correct variable for r equals zero or (r = 0). However, when the correct variable for (r) would differ from zero (0) then the equation would produce incorrect results.

Again, the correction to the equation is to add for (r) or return-on-investment (ROI), which can be a positive or a negative value.

The complete and correct equation is (m = c - d + r).

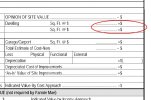

Please see my attached report for a more detailed explanation.

This current equation comes from the depreciated cost method which is market value (m); equals the cost to build the improvements new (c); minus any depreciation (d); plus the cost of the site (s); or (m = c - d + s).

This equation has been modified to determine the contributory value of a feature, such as an In-ground pool, enclosed deck, flooring, upgraded kitchen, bathrooms, etc., by removing the site factor (s) since it no longer applies. Leaving the equation of (m = c - d).

However, this modification has left the equation incomplete as it only works part of the time.

The correction to the equation is to add for (r) or return-on-investment (ROI), which can be a positive or a negative value.

The complete and correct equation is (m = c - d + r).

The reason the current equation would work part of the time is when the correct variable for r equals zero or (r = 0). However, when the correct variable for (r) would differ from zero (0) then the equation would produce incorrect results.

Again, the correction to the equation is to add for (r) or return-on-investment (ROI), which can be a positive or a negative value.

The complete and correct equation is (m = c - d + r).

Please see my attached report for a more detailed explanation.