- Joined

- Jan 15, 2002

- Professional Status

- Certified General Appraiser

- State

- California

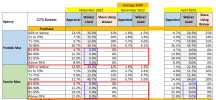

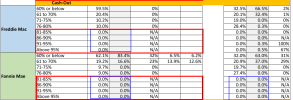

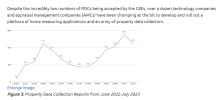

Your friends at American Enterprise Institute keep track of GSE activity on the monthly basis:

www.aei.org

www.aei.org

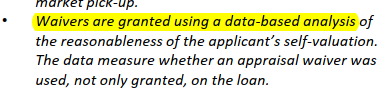

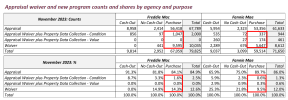

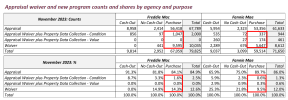

Prevalence of GSE Appraisal Waivers

The use of appraisal waivers at the GSEs has exploded in recent months and now accounts for over 40% of all valuations.

Last edited: