OllieGarchy

Junior Member

- Joined

- Nov 22, 2003

- Professional Status

- Certified Residential Appraiser

- State

- California

My wife and I will be selling our house. There are plenty of comps right in the neighborhood, including model matches. When the Buyer's Lender's appraiser comes out, there shouldn't be a problem.

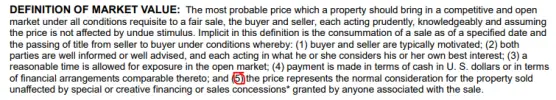

However, we just recently learned that our mortgage is assumable (we're getting written confirmation from the lender). It's at a fixed 3.5% until 2047. With current average mortgage rates at around 6.75%, this presents a great savings opportunity for the buyer, should he or she assume it. So, whatever the comps indicate now, this savings is a premium and should be added on to the final purchase price.

Just to be clear, I don't care what this premium is. I don't care to know how to figure it out (at least not yet).

What I want to make sure of, though, is whomever the buyer's lender sends out to appraise our property, that appraiser will know how to value the assumable loan savings.

So how can our Listing Agent prepare for this?

Thanks.

However, we just recently learned that our mortgage is assumable (we're getting written confirmation from the lender). It's at a fixed 3.5% until 2047. With current average mortgage rates at around 6.75%, this presents a great savings opportunity for the buyer, should he or she assume it. So, whatever the comps indicate now, this savings is a premium and should be added on to the final purchase price.

Just to be clear, I don't care what this premium is. I don't care to know how to figure it out (at least not yet).

What I want to make sure of, though, is whomever the buyer's lender sends out to appraise our property, that appraiser will know how to value the assumable loan savings.

So how can our Listing Agent prepare for this?

Thanks.