AI: "Is it probable that a real estate appraiser could produce 'quantifiable market-derived methods' for a single family house. If so, would you provide an example?"

["It is highly probable that a real estate appraiser could produce quantifiable market-derived methods when appraising a single-family house, as these are fundamental to professional property valuation. The most common example is the Sales Comparison Approach, where the appraiser uses recent sales of comparable homes to determine value adjustments.

Example: Sales Comparison Approach

In this method, the appraiser identifies properties similar to the subject house that have recently sold in the area. The appraisal process involves:

• Collecting sale prices of comparable homes within a similar neighborhood.

• Making dollar or percentage adjustments to account for differences in features (e.g., extra bedrooms, renovated kitchens, lot size).

• Using statistical or mathematical techniques (such as regression modeling or paired-sales analysis) to quantify how each feature affects market value.

• Calculating a final value estimate for the subject property based on market data.

For instance, if a comparable house sold for $400,000 and had one less bedroom than the subject, and the market data shows that an extra bedroom typically adds $15,000 in value, the appraiser would adjust the comparable’s sale price up to $415,000 for comparison purposes."]

"In using regression analysis for adjustments for single family homes, what coefficient of determination would be expected that would be considered reliable? Cite studies."

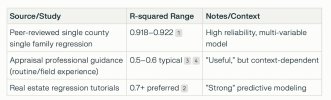

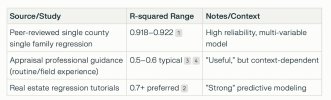

"A coefficient of determination (R-squared) that is considered reliable for regression analysis in single family home appraisals often falls in a wide range, but values above 0.7 are generally preferred for strong predictive modeling, though much lower values can still produce useful adjustments in practice. Studies and expert commentaries highlight that in real-world property analysis, R-squared values between 0.5 and 0.9 are commonly reported, with reliability depending on context and the presence of multiple influential variables.

Expectations from Studies and Industry Guidance

• One peer-reviewed study demonstrated a model with R-squared of 0.92 (adjusted 0.91) using twelve independent variables in a countywide single-family dataset, noting that robust results can be achieved with comprehensive data and relevant variables.

• Practical appraisal discussions emphasize that while a higher R-squared is better, real estate data is inherently “messy,” and appraisers frequently encounter reliable adjustments even when the R-squared is as low as 0.5 to 0.6. Lower R-squared values do not inherently invalidate regression results; much depends on data selection, coverage of variables, and purpose.

• Appraisers and statistical references caution not to use R-squared as the sole measure of reliability, noting that market complexity, omitted variables, and neighborhood characteristics can lower R-squared, even when the calculated adjustments are market-extracted and relevant.

Cited Examples

• Case Study: A published regression analysis of single-family home sales using four variables yielded an R-squared of 0.918 (adjusted 0.917), presenting this as strong evidence of a highly reliable model for the given data set.

• Professional Commentary: Appraisers often achieve reliable support for adjustments with R-squared values of 0.5 or above, though robustness increases with higher values when other model diagnostics are favorable.

Summary Table: Sample Study R-squared Values

In summary, for regression-based adjustments in single family home appraisals, an R-squared above 0.7 is desirable for reliability, but values from 0.5 upward may still provide credible results when paired with sound appraisal practice and market insight."

.....................

Now the R^2 that the GSEs relied upon to determine appraisers were racial bias was 0.04. Which was considered 'proof'.