OG80

Sophomore Member

- Joined

- May 3, 2021

- Professional Status

- Appraiser Trainee

- State

- Texas

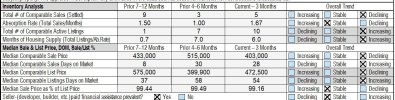

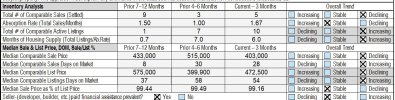

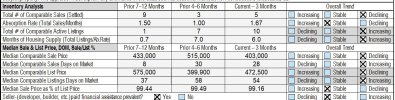

Just turned in my 1st report using the Time Adjustments requested. And here is the very first revision request. I knew that when they differed, that

1004MC data indicates Declining price trend (and positive time adjustments are applied in the sales grid – please confirm / revisit if necessary or clarify (and indicate how the adjustments were determined / applied)

Here are my "Market Conditions" Explanation of what I searched for:

Broad Market Conditions

Search Criteria Description: To the West zzz, to the East zzz to the South. Includes Detached units with a lot size of up to 10,000 sq ft and a Finished Area Above Grade between 1788 and 2683 sq. ft. Additional factors include between 3-4 bedrooms and 2 baths. Searched dates are 800 days prior.

Date of sale search was extended to include sales up to 800 days. Adjustments reflect changes in the competing market median sale price per month within the board market. The following specific adjustments were applied: Comp #1: A 1.61% change from sale date, rounded to $6,487. Comp #2: A 2.57% change from sale date, rounded to $13,260. Comp #3: A 5.91% change from sale date, rounded to $26,419. Comp #4: A 12.98% change from sale date, rounded to $46,719. (DATAMASTER)

Here is the 1004C

Anybody have a good response to this?

1004MC data indicates Declining price trend (and positive time adjustments are applied in the sales grid – please confirm / revisit if necessary or clarify (and indicate how the adjustments were determined / applied)

Here are my "Market Conditions" Explanation of what I searched for:

Broad Market Conditions

Search Criteria Description: To the West zzz, to the East zzz to the South. Includes Detached units with a lot size of up to 10,000 sq ft and a Finished Area Above Grade between 1788 and 2683 sq. ft. Additional factors include between 3-4 bedrooms and 2 baths. Searched dates are 800 days prior.

Date of sale search was extended to include sales up to 800 days. Adjustments reflect changes in the competing market median sale price per month within the board market. The following specific adjustments were applied: Comp #1: A 1.61% change from sale date, rounded to $6,487. Comp #2: A 2.57% change from sale date, rounded to $13,260. Comp #3: A 5.91% change from sale date, rounded to $26,419. Comp #4: A 12.98% change from sale date, rounded to $46,719. (DATAMASTER)

Here is the 1004C

Anybody have a good response to this?