cdanj

Junior Member

- Joined

- Nov 19, 2013

- Professional Status

- Certified Residential Appraiser

- State

- New Jersey

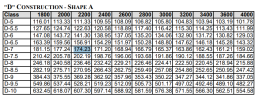

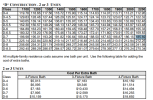

I've been getting these new construction hard money loan appraisals on 2 Family and three family dwelings that are being built with the intention of each unit being sold as conod units and they want cost approach. Also, I've been using dwellingcost.com

A two family side by side in my market is viewed by the public and treated by the owners as 1/2 duplex, gnerally with the owners having a simple agreement and insuance policy.

So, I guess the cost approach would take the entire exterior measurements and halve them.

But a top/bottom three unit building. Would I do the same and just 1/3 them?

A two family side by side in my market is viewed by the public and treated by the owners as 1/2 duplex, gnerally with the owners having a simple agreement and insuance policy.

So, I guess the cost approach would take the entire exterior measurements and halve them.

But a top/bottom three unit building. Would I do the same and just 1/3 them?