jyoder35

Freshman Member

- Joined

- Jan 8, 2022

- Professional Status

- Banking/Mortgage Industry

- State

- Arizona

Hi all!

I'm a mortgage broker and have a client that made an offer on a quadplex with minimum down payment on an FHA loan. I'm concerned we won't pass the FHA's self sufficiency test. We need to have the total PITI payment to be under 75% of the appraiser's estimate of fair market rent for all units. Mortgage payment is going to be around $4100, so we'd need roughly $5500/ month in rental income to qualify.

The property is made up of 3 1BR/1BA unit and one 2BR/1BA units.

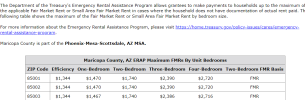

I found on Huduser.gov the Fair Market Rent Documentation System linked below, which allows you to see a specific FMR based on zip code.

If we use this system, we'd have around $1400/ month for each 1 BR and $1700 for the 2BR.

As an appraiser, would/ could you use this number in determining Fair Market Rent? Or would you calculate it? Would existing leases play in?

If we can use HUD's Fair Market Rent number, we are good. If it's based on something else, I'm concerned.

Any guidance is massively appreciated!

I'm a mortgage broker and have a client that made an offer on a quadplex with minimum down payment on an FHA loan. I'm concerned we won't pass the FHA's self sufficiency test. We need to have the total PITI payment to be under 75% of the appraiser's estimate of fair market rent for all units. Mortgage payment is going to be around $4100, so we'd need roughly $5500/ month in rental income to qualify.

The property is made up of 3 1BR/1BA unit and one 2BR/1BA units.

I found on Huduser.gov the Fair Market Rent Documentation System linked below, which allows you to see a specific FMR based on zip code.

If we use this system, we'd have around $1400/ month for each 1 BR and $1700 for the 2BR.

As an appraiser, would/ could you use this number in determining Fair Market Rent? Or would you calculate it? Would existing leases play in?

If we can use HUD's Fair Market Rent number, we are good. If it's based on something else, I'm concerned.

Any guidance is massively appreciated!