-

Welcome to AppraisersForum.com, the premier online

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GLA Adjustments

- Thread starter OG80

- Start date

Dublin ohio

Elite Member

- Joined

- Mar 20, 2008

- Professional Status

- Licensed Appraiser

- State

- Ohio

With market data and refine it with a sensitivity analysis. No "hard" number or set percentage and I don't adjust to the foot because I am not that good and neither is the dataHey Guys and Gals,

How do you determine your GLA adjustments (hard number or %) and how do you explain it in your report?

As always thank you very much for your comments.

NC Appraising

Elite Member

- Joined

- Apr 28, 2006

- Professional Status

- Certified Residential Appraiser

- State

- North Carolina

1. New construction. Compare base prices for model homes. Data is data. Can use it for Resale or new construction homes of similar price points.

2. Regression. I use synapse. One of the few areas I kinda trust the results. If not done right, it can be high. You still have to filter the data.

https://gandysoft.com/ a other option

3. Ratterman method.

4. Group data analysis. Download some sales in a template and in alamode there is the smart adjust feature.

5. Mass MLS data. Most have a stats tab.

Pick a pud or subdivision. Make all equal...two car garage, bath count, no pool, etc. Go through it and take out condition or quality outliers.

One search say 1400-1600 sqft next search 1700-1900 sqft. Screen shot and put in report. You still gotta do the math. Seems like a lot of time, but maybe 5 minutes. It will give you avg and median...do the math.

6. Tract home puds...matched pairs. Similar to above. If your MLS has a single line item data tab, rearrange by GLA. Makes finding matched pairs easier. This method alo works for Condition and quality.

7. Cost depreciation

www.appraiser-toolkit.com

[URL

www.appraiser-toolkit.com

[URL

www.solomonappraisal.com

www.solomonappraisal.com

Scroll down in comments section link to download excel GLA

2. Regression. I use synapse. One of the few areas I kinda trust the results. If not done right, it can be high. You still have to filter the data.

https://gandysoft.com/ a other option

3. Ratterman method.

4. Group data analysis. Download some sales in a template and in alamode there is the smart adjust feature.

5. Mass MLS data. Most have a stats tab.

Pick a pud or subdivision. Make all equal...two car garage, bath count, no pool, etc. Go through it and take out condition or quality outliers.

One search say 1400-1600 sqft next search 1700-1900 sqft. Screen shot and put in report. You still gotta do the math. Seems like a lot of time, but maybe 5 minutes. It will give you avg and median...do the math.

6. Tract home puds...matched pairs. Similar to above. If your MLS has a single line item data tab, rearrange by GLA. Makes finding matched pairs easier. This method alo works for Condition and quality.

7. Cost depreciation

Appraiser-Toolkit

Calculators — Solomon Adjustment Calculator

https://www.workingre.com/a-spreadsheet-solution-for-estimating-GLA-adjustments/

Scroll down in comments section link to download excel GLA

Last edited:

weird_limbs

Freshman Member

- Joined

- Jul 27, 2024

- Professional Status

- Appraiser Trainee

- State

- Minnesota

Most folks use Valuation Labs for time adjustments, but they’ve also got a solid Site and GLA adjustments tool too.

- Joined

- May 22, 2015

- Professional Status

- Certified Residential Appraiser

- State

- Pennsylvania

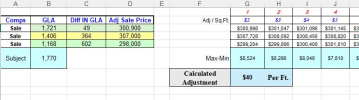

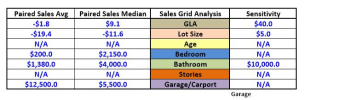

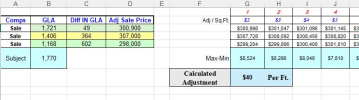

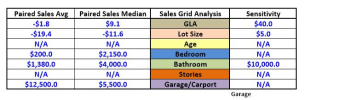

Generally, GLA adjustments are treated as contributory value, not cost to build. The GLA adjustment is the last adjustment made on the market grid. The proper SF (GLA- gross living area) adjustment is that which tightens the range of adjusted values, that results in the smallest range of adjusted values, determined by using simple regression & sensitivity.. I followed the ANSI Z765 standard when I measured the house. However, with obstacles around the house that precludes direct measurements, such as junk, debris, landscaping etc, and set-backs on upper levels or steep inaccessible walls with drop-offs, GLA is estimated and not guaranteed. The ANSI Z765 standard is not intended to supercede any locally imposed system of residential measurement. It may, in many places around the country, challenge long standing paradigms. The gross living area reported is the square footage measured with the ANSI Z765 standard. The sketch is an approximation, and may not be exact.

J Grant

Elite Member

- Joined

- Dec 9, 2003

- Professional Status

- Certified Residential Appraiser

- State

- Florida

I extract it from the comps on the grid - adjust for all the other key factors, and the last adjustment left is the GLA $ per sf. Fill in the amount indicated to narrow the adjusted range of the comp sales. Sometimes it needs a further tweaking of $ per sf.

It also should have a relationship to the cost approach ( and Q rating/). In a house that is $400 a sf to build, a $50 per sf adjustment is ludicrous. Tryp $150 a sf or $200 a sf. Same on the low end , if it cst $150 a sf to build, then $50-$75 a sf might correlate. However, there is no formula, and each appraisal is different.

In a small condo, for example, there is no land t factor in and ever sf counts. I might adjust higher per sf for a 700 sf condo then for a 2000 sf house. As another poster noted, $ per sf is contributory value, not $ cost to build.

For smaller differences among the comp and subject,t I might not adjust at all - and then there is the over improvement of too large a dwelling- take your time and develop it in each appraisal. I personally do not want to outsource such an important adjustment to a computer program - if I were to do that, I would want to take the software results and test it with the comps on the grid and relative to the cost approach. I do not recommend just dumping the results of a software program into the appraisal - it can create misleading results.

It also should have a relationship to the cost approach ( and Q rating/). In a house that is $400 a sf to build, a $50 per sf adjustment is ludicrous. Tryp $150 a sf or $200 a sf. Same on the low end , if it cst $150 a sf to build, then $50-$75 a sf might correlate. However, there is no formula, and each appraisal is different.

In a small condo, for example, there is no land t factor in and ever sf counts. I might adjust higher per sf for a 700 sf condo then for a 2000 sf house. As another poster noted, $ per sf is contributory value, not $ cost to build.

For smaller differences among the comp and subject,t I might not adjust at all - and then there is the over improvement of too large a dwelling- take your time and develop it in each appraisal. I personally do not want to outsource such an important adjustment to a computer program - if I were to do that, I would want to take the software results and test it with the comps on the grid and relative to the cost approach. I do not recommend just dumping the results of a software program into the appraisal - it can create misleading results.

J Grant

Elite Member

- Joined

- Dec 9, 2003

- Professional Status

- Certified Residential Appraiser

- State

- Florida

If one is learning, (which can be any time in our careers) and needs to see how things work, try it on a dummy appraisal, go back and re work an old appraisal after cloning it and try different methods - that way you are not under pressure of a real assignment.

Zoe

Elite Member

- Joined

- Sep 15, 2020

- Professional Status

- Certified General Appraiser

- State

- Tennessee

I agree. If I my other adjustments are based on something I can hang my hat on, the GLA adjustment is the last one I make based on sensitivity analysis which what draws the indicated values closest together on the comparables.My go to methods are regression and sensitivity analysis. Other things work, but I found those the best for me.

Sometimes I have to go back and look at other adjustments and make sure I didn't screw up there somewhere. But GLA is last adjustment I make.

And it is the number that draws the indicated values closest together like Tom said.

Sensitivity analysis in its purest form.

Zoe

Elite Member

- Joined

- Sep 15, 2020

- Professional Status

- Certified General Appraiser

- State

- Tennessee

Sensitivity analysis is easy on an HP12C calculator. Just a few key strokes and bam, you know if GLA adjustment is too high or too low. The number that is close on GLA adjustment will draw the indicated values closest together. Standard deviation basically. It is not multiple regression analysis. If all you other adjustments are well founded, the sensitivity analysis will draw the GLA adjustment closest together on the indicated value of the comparables.