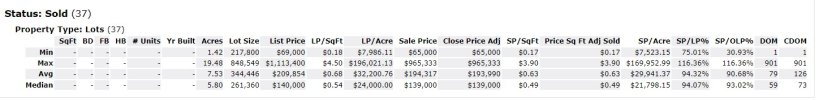

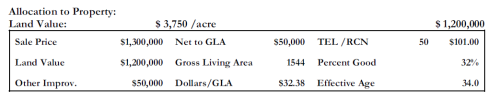

Here are lot sales w/in 10 miles of subject (5 - 20 acres). Using the Median I give the 10 acres a value of $213,400 (435,600 X $0.49) OR do I give the one acre the subject sits on the value of $21,344 (43,560 sq ft X $0.49) and give the 9 acres of "excess land?" a value of $66,646 (392,040 sq ft X $0.17) so when I make adjustments on the land of the comparables, I am making the adjustments at $0.17/sq ft vs $0.49 s/f. I take one acre on each comparable away to be the same as the subject and then make adjustments on the excess land at $0.17 s/f. Does that make sense?

What are the parcel sizes of your comparables? What are their respective land values like? If your comps are on 1ac lots, then the difference in land value between the 1ac lots and the larger lots is your adjustment factor.

You're also going to need more sales than that, and you're going to need to take a hard look at what each of those parcels is/isn't. What's the access like (paved or unpaved). What's the topo like. What utilities do they have access to? etc. You basically have to appraise your entire 10ac as if vacant in order to figure out the value of the underlying land.

I appraise land on a regular basis and I often have to go back 1-2 years for my comps. I also look at every listing that has been active during that time frame in order to see what pricing did and didn't sell. Sometimes I'll go back in time further than that - not to find comps, per se, but to get a feel for what the pricing has been in the past. I'm not using medians and averages, either; I'm reconciling for what I think these parcels will actually sell for.

As for scope of practice on your license, the AQB says that if you're licensed to appraise whatever would go on that parcel under it's highest and besrt use then you can appraise the land. So if the HBU for this parcel is 1-4 units then a CR can appraise the property. If the HBU is other than that then there may be more elements in play than the average CR has been trained to deal with. In any case, your state regs lay out what the scope of practice is for your license; if working under supervision then it's your supervisor's license that counts.

Remember, the expectations for what you do on this one are what an appraiser who commonly does this type of thing does. If this parcel is good for a 10-unit residential subdivision then then expectations are for what a CG who does subdivision-potential parcels would do. OTOH is the parcel is only good for 1-4 units then the expectations are for what a CR who does residential parcels does. There will be some similarities between the two types of assignments as well as some differences.

P.S. for a single parcel at that size it's price/ac, not price/sf. If the HBU allows more than one unit it would commonly be price/unit, not size-based.