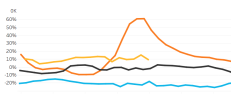

An almost 40% lower supply of housing available for sale post-pandemic.

Home Sales in March Had Biggest Decline in 16 Months

Sales of previously owned homes decreased 4.3% from the prior month.

By

Nicole Friedman

Updated April 18, 2024, 10:33 am ET

A persistently low supply of homes for sale is helping push prices higher. PHOTO: DAVID RYDER/BLOOMBERG NEWS

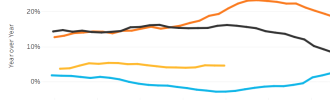

Home sales in March posted their biggest decline in more than a year, reversing course after a positive start this year as rising mortgage rates frightened off buyers.

Sales of previously owned homes decreased 4.3% from the prior month to a seasonally adjusted annual rate of 4.19 million, the National Association of Realtors said Thursday. It was the biggest percentage decline on a monthly basis since November 2022, NAR said.

After sales tumbled to their

lowest level in nearly 30 years in 2023, activity picked up to start this year. Home

sales rose during the first two months as

buyers took advantage of a decline in rates and active listings that ticked higher early in the year.

But mortgage rates rose again in February. That sent buyers to the sidelines and it now threatens to squash momentum during the crucial spring home-buying season, which is typically the busiest time of year in the housing market.

The average rate on a 30-year fixed mortgage has

moved back toward 7%, according to Freddie Mac. While many economists expect rates to decline later this year,

stronger-than-expected inflation data last week could prompt Federal Reserve officials to hold rates at their current level for longer. That could also keep mortgage rates from declining.

Home buyers are also confused about

coming changes to rules about how real-estate agents get paid, and whether those changes could increase or decrease their costs. That is causing some home shoppers and sellers to pause until there is more clarity when the new rules go into effect in July.

“There’s so many mixed signals now in the market that for many people, it’s just too much,” said Selma Hepp, chief economist at CoreLogic. “I think they’re just sitting it out.”

While higher mortgage rates make home purchases more expensive for many buyers, a persistently low supply of homes for sale is also pushing prices higher.

The national median existing-home price rose 4.8% in March from a year earlier to $393,500, NAR said.

“Home sales are essentially stuck,” said Lawrence Yun, NAR’s chief economist. “We need more inventory, definitely.”

On an annual basis, existing home sales fell 3.7% in March. These sales make up most of the housing market.

Economists surveyed by The Wall Street Journal estimated sales of previously owned homes fell a seasonally adjusted 4.8% in March from February.

Homes typically go under contract a month or two before the contracts close, so the March data largely reflect purchase decisions made in February and January.

For some who bought in March, they found less competition. David Bramlett and Alexandra Hodson started house hunting last fall but decided to wait. When they re-entered the market this year, interest rates had declined, Bramlett said.

David Bramlett and Alexandra Hodson bought a home in coming, Ga., in March. PHOTO: JAMIE LEE YAWN

The couple bought a four-bedroom home with a yard in coming, Ga., in March for $480,000.

“There was no bidding war,” Bramlett said. “It was good to get in when we did, where we did, with a motivated seller.”

But affordability has worsened in recent weeks. The median monthly payment for a home purchase rose to $2,747 in the four weeks ended April 7, up 11% from a year earlier, according to real-estate brokerage

Redfin.

“March and April slowed down tremendously,” said Clint Jordan, a real-estate agent in Colorado Springs, Colo. “Rates are a little bit higher, so a lot of our buyers are sitting back.”

The share of first-time buyers in the market was 32% in March, up from 28% a year earlier. About 28% of March existing-home sales were purchased in cash, up from 27% in the same month a year ago, NAR said.

The typical home sold in March was on the market for 33 days, up from 29 days a year earlier, NAR said.

Nationally, there were 1.11 million homes for sale or under contract at the end of March, up 4.7% from February and up 14.4% from March 2023, NAR said. At the current sales pace, there was a 3.2-month supply of homes on the market at the end of March.

Despite the increase in inventory, the supply of homes for sale in March was still 37.9% below typical pre-pandemic levels, according to Realtor.com.

But some markets are more amply supplied. In San Antonio, inventory in March was 27% above pre-pandemic levels.

“It is a buyer’s market now,” said Maricela Mares Castillo, a real-estate agent in San Antonio. “They don’t have to settle as much as they may have last year.”

News Corp, owner of the Journal, also operates Realtor.com under license from NAR.

Write to Nicole Friedman at

nicole.friedman@wsj.com