Mejappz

Elite Member

- Joined

- Dec 16, 2005

- Professional Status

- Certified Residential Appraiser

- State

- Florida

Impersonating an Appraiser – The Costly Consequences of Playing Dress-Up in Real Estate.

Being an appraiser isn’t for the faint of heart. The job requires thick skin, a strong moral compass, and an unwavering commitment to impartiality. There are times when you have to stand your ground, even when clients plead with you to sway the value. Sometimes, the market tells a story that’s not what people want to hear. Whether it’s a low appraisal for a refinance or a high one for a divorce, appraisers have to stay true to the facts. No matter how much pressure is applied. Objectivity is everything.

That’s exactly what I was reminded of when I met Abigail, a kind, elderly lady who had recently purchased a distressed, estate-owned two-family home. Abigail’s dream was to renovate the property and hold it as a rental, something she could only do with a high-interest construction loan. She’d poured everything she had into it—money, time, sweat. Six months later, after an exhaustive renovation, the house was complete and it was time to refinance and lower the staggeringly high monthly payments. And that’s when I arrived to complete the appraisal.

After the inspection—measuring, photographing, assessing the property—I returned to my office to prepare the report. The next day, the numbers came in. The market trends, the adjustments, the comps—all of it led to a number that was far lower than Abigail expected.

The calls started almost immediately.

First came the loan officer, pushing back, citing how the last appraiser had come in much higher and how that appraisal had allowed her to borrow money to purchase and renovate the home. Now, with the current appraisal, the deal was dead. Then, Abigail herself, her voice cracking with frustration and fear. “Why is my house worth so much less now?” she demanded. “I’ve done everything right and the market is going up!”

Her distress was evident. This wasn’t just a financial loss; it was her dream crumbling. With her high-interest loan now unmanageable and no way to refinance, Abigail found herself trapped. The renovation had become a nightmare.

I felt horrible, and to be honest, a little defensive, so I offered to take a look her prior appraisal. What I discovered made my stomach turn.

The previous appraisal had been done by a real estate agent—a realtor, not a licensed appraiser. There were 2 estimates of market value listed: an “as-is” estimate and a post-renovation value, and a suggested list price “as is” and post renovations. But here’s the catch: these values were artificially inflated, clearly padded to meet loan requirements, with no support from legitimate comparable data or proper appraisal methodology. They were high enough to make the numbers work for the deal, but not at all reflective of the true market value.

I was shocked.

It turns out that the national appraisal management company behind the valuation had knowingly hired this realtor to conduct the appraisal. Their goal? Maximize their profits by using someone who wasn’t qualified for the job. They charged Abigail for an appraisal, yet she was unknowingly left with a report that wasn’t worth the paper it was printed on. Worse, the realtor—posing as an appraiser—had skewed the numbers, and now Abigail had over-improved the property based on those inflated values. Unable to refinance out of her renovation loan, foreclosure loomed on the horizon.

I could only imagine her despair. The system had failed her, and now, she was paying the price.

It wasn’t just Abigail who was affected, though. The realtor’s actions were illegal. In many states, realtors are only allowed to estimate a list price with the sole purpose to try and obtain a listing and only certified appraisers are permitted to give formal property valuations, and for good reason. When someone steps outside the lines, they put everyone at risk—borrowers, lenders, and even themselves.

After multiple hearings with the State Board and mounting legal fees, the real estate agent’s attorney finally struck a deal. Jail time was off the table, but the agent still faced a hefty fine for impersonating an appraiser.

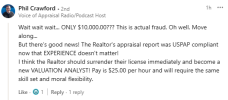

The final penalty for impersonating an appraiser? $10,000.

Meanwhile, the appraisal management company remains under investigation. The penalties for their role? Still to be determined.

This is a warning to all involved in the real estate and appraisal industries: cutting corners for profit comes at a cost. The Uniform Standards of Professional Appraisal Practice were established to ensure public trust. When those guidelines are ignored—whether by national appraisal management companies or unethical realtors—the damage is far-reaching. Not only does it jeopardize public trust, but it also risks severe legal consequences.

For realtors and appraisal management companies: consider this your wake-up call. State agencies are watching. And next time, it could be you.

appraisersblogs.com

appraisersblogs.com

Being an appraiser isn’t for the faint of heart. The job requires thick skin, a strong moral compass, and an unwavering commitment to impartiality. There are times when you have to stand your ground, even when clients plead with you to sway the value. Sometimes, the market tells a story that’s not what people want to hear. Whether it’s a low appraisal for a refinance or a high one for a divorce, appraisers have to stay true to the facts. No matter how much pressure is applied. Objectivity is everything.

That’s exactly what I was reminded of when I met Abigail, a kind, elderly lady who had recently purchased a distressed, estate-owned two-family home. Abigail’s dream was to renovate the property and hold it as a rental, something she could only do with a high-interest construction loan. She’d poured everything she had into it—money, time, sweat. Six months later, after an exhaustive renovation, the house was complete and it was time to refinance and lower the staggeringly high monthly payments. And that’s when I arrived to complete the appraisal.

After the inspection—measuring, photographing, assessing the property—I returned to my office to prepare the report. The next day, the numbers came in. The market trends, the adjustments, the comps—all of it led to a number that was far lower than Abigail expected.

The calls started almost immediately.

First came the loan officer, pushing back, citing how the last appraiser had come in much higher and how that appraisal had allowed her to borrow money to purchase and renovate the home. Now, with the current appraisal, the deal was dead. Then, Abigail herself, her voice cracking with frustration and fear. “Why is my house worth so much less now?” she demanded. “I’ve done everything right and the market is going up!”

Her distress was evident. This wasn’t just a financial loss; it was her dream crumbling. With her high-interest loan now unmanageable and no way to refinance, Abigail found herself trapped. The renovation had become a nightmare.

I felt horrible, and to be honest, a little defensive, so I offered to take a look her prior appraisal. What I discovered made my stomach turn.

The previous appraisal had been done by a real estate agent—a realtor, not a licensed appraiser. There were 2 estimates of market value listed: an “as-is” estimate and a post-renovation value, and a suggested list price “as is” and post renovations. But here’s the catch: these values were artificially inflated, clearly padded to meet loan requirements, with no support from legitimate comparable data or proper appraisal methodology. They were high enough to make the numbers work for the deal, but not at all reflective of the true market value.

I was shocked.

It turns out that the national appraisal management company behind the valuation had knowingly hired this realtor to conduct the appraisal. Their goal? Maximize their profits by using someone who wasn’t qualified for the job. They charged Abigail for an appraisal, yet she was unknowingly left with a report that wasn’t worth the paper it was printed on. Worse, the realtor—posing as an appraiser—had skewed the numbers, and now Abigail had over-improved the property based on those inflated values. Unable to refinance out of her renovation loan, foreclosure loomed on the horizon.

I could only imagine her despair. The system had failed her, and now, she was paying the price.

It wasn’t just Abigail who was affected, though. The realtor’s actions were illegal. In many states, realtors are only allowed to estimate a list price with the sole purpose to try and obtain a listing and only certified appraisers are permitted to give formal property valuations, and for good reason. When someone steps outside the lines, they put everyone at risk—borrowers, lenders, and even themselves.

After multiple hearings with the State Board and mounting legal fees, the real estate agent’s attorney finally struck a deal. Jail time was off the table, but the agent still faced a hefty fine for impersonating an appraiser.

The final penalty for impersonating an appraiser? $10,000.

Meanwhile, the appraisal management company remains under investigation. The penalties for their role? Still to be determined.

This is a warning to all involved in the real estate and appraisal industries: cutting corners for profit comes at a cost. The Uniform Standards of Professional Appraisal Practice were established to ensure public trust. When those guidelines are ignored—whether by national appraisal management companies or unethical realtors—the damage is far-reaching. Not only does it jeopardize public trust, but it also risks severe legal consequences.

For realtors and appraisal management companies: consider this your wake-up call. State agencies are watching. And next time, it could be you.

Realtor Fined $10,000 for Impersonating an Appraiser - Appraisers Blogs

Jail time was off the table, but the real estate agent still faced a hefty fine for impersonating an appraiser.