- Joined

- Sep 23, 2004

- Professional Status

- Certified Residential Appraiser

- State

- Texas

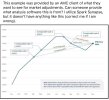

Your saying the computers did a good job of predicting credit worthiness during this period?I heard others were decline/got rid of. During recession, my line of credit was left opened.

AI must be doing their job well knowing who were credit worthy.

Question: How much did the 2008 market crash cost?

Answer: Between 2007 and 2009, U.S. households lost over $16 trillion in net worth, the value of the stock market fell by half, and unemployment reached 10% as the crisis turned into the Great Recession..