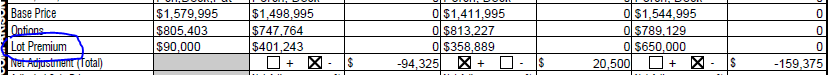

The problem I've seen is the rarity when a "concession" is not a dollar for dollar impact upon the seller's resulting net from the sale. AND, that it deviates by about that amount from the comparables where no concessions are made. Here we only recently have seen Horton et al come to town and offer incentives - noticed one the other day - offering 4.99% interest loan from their preferred lender. Well, the lender isn't going to leave money at the table so the developer is paying down points - and the real (inflated) price reflects that expense of the builder-developer. It seems to be the curious case where buyers are enticed to pay more with lower interest rates than the seller to lower the price accordingly. I am waiting for the return of 2008 when such incentives included your choices of either a world cruise, bass boat, Hummer, one years cleaning service or six months making your mortgage payment. Folks, that's a no brainer. No matter if 100% of builders offers that same incentive, it is money right off the top. Cash equivalent value... Market Value defines

I would argue any non-cash sale that has concessions by definition is not "in terms of financial arrangements comparable thereto". It must be adjusted and that adjustment is rarely anything but dollar for dollar.