- Joined

- Mar 11, 2008

- Professional Status

- Certified Residential Appraiser

- State

- Texas

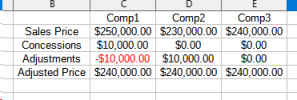

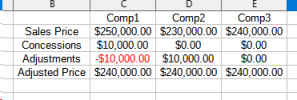

Case in point: the following scenario is presented for consideration:

Note that, if I adjust Comp1 for concessions, it will now have an adjusted price of $230,000, which would be artificially lowering Comp1's adjusted price, as - clearly - the concession didn't impact the sales price. In this case, I would not adjust for the concession. Again, though - others gotta do what they think is right. I'm just telling you how we are required to adjust IF we are reporting on the F/F forms.

Note that, if I adjust Comp1 for concessions, it will now have an adjusted price of $230,000, which would be artificially lowering Comp1's adjusted price, as - clearly - the concession didn't impact the sales price. In this case, I would not adjust for the concession. Again, though - others gotta do what they think is right. I'm just telling you how we are required to adjust IF we are reporting on the F/F forms.