- Joined

- May 2, 2002

- Professional Status

- Certified General Appraiser

- State

- Arkansas

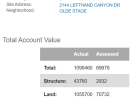

In Colorado, home prices are assessed every two years for tax purposes. As the values increase, so do the taxes. Recently, Boulder County saw a massive increase in property values because the new appraisals were based on home sales during the pandemic, when demand in Boulder County surged. Boulder County Assessor Cynthia Braddock told CBS the median increase in the county was 35%.

“It is painful to send out an assessment that large, knowing it will impact people’s ability to pay their taxes,” Braddock told reporters.

But it did not stop her from sending those out, did it? Welcome to the Peoples Republic of Colorado. I wrote them a check for $641 last week in addition to the ad valorem taxes already taken, the severance tax (7%), conservation tax 3.5%, and income taxes. My taxes are based on commercial assessment rates that are 12 x that of a house. I could not afford to live in the state.