App1968CT

Freshman Member

- Joined

- Jun 23, 2023

- Professional Status

- Certified Residential Appraiser

- State

- New York

I assume these are land sales? Most neighborhoods in the NJ/CT/NY area don't have enough land sales to produce something like this for support. How do you support your site adjustments when there are basically no land sales available?I would expect that significant differences are supported by data and logic.

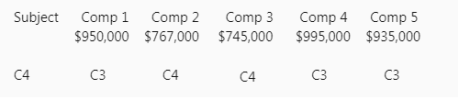

Like here is how I support a lot size adjustment. You can see that the value of 1.2 acres is around $2 million and the value of a half acre lot is around $1.1 million. 6611 Lybrook Ct sold for $1.45 million but it was permit approved and shovel ready. So if your subject is a half acre lot in this neighborhood, and your comp is a one acre lot, then the adjustment would be around $900k.

View attachment 103038