SumthinU

Freshman Member

- Joined

- Sep 15, 2023

- Professional Status

- Licensed Appraiser

- State

- Maine

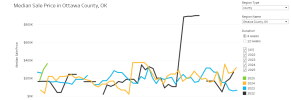

I work in a very rural area where housing varies greatly in all respects. With that said, am I the

only one who feels he was not able to see a slightly increasing market with confidence while

he was in the middle of it ? I can see it now through historic comparisons, but at the time, not

enough data for certainty. How much market activity are appraisers using before being confident

in determining direction ?

only one who feels he was not able to see a slightly increasing market with confidence while

he was in the middle of it ? I can see it now through historic comparisons, but at the time, not

enough data for certainty. How much market activity are appraisers using before being confident

in determining direction ?