- Joined

- Apr 23, 2002

- Professional Status

- Certified General Appraiser

- State

- Oregon

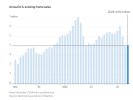

(WSJ 1/24/25) "U.S. existing-home sales fell in 2024 to the lowest level since 1995, the second straight year of anemic sales due to stubbornly high mortgage rates.

High costs related to homeownership sapped sales again. The average rate for a 30-year fixed mortgage has hovered between 6% and 8% since late 2022, making it prohibitively expensive for many Americans to buy homes at current prices, which hit record highs last year. Rising home insurance and property tax costs are also adding to homeowners’ expenses.

Home prices have continued rising on a year-over-year basis, because the inventory of homes for sale is lower than historically normal levels. Inventory is up from year-ago levels, but supply is still tight in many markets because many would-be sellers with low mortgage rates are unwilling to sell and take on a higher rate to buy a different home."

High costs related to homeownership sapped sales again. The average rate for a 30-year fixed mortgage has hovered between 6% and 8% since late 2022, making it prohibitively expensive for many Americans to buy homes at current prices, which hit record highs last year. Rising home insurance and property tax costs are also adding to homeowners’ expenses.

Home prices have continued rising on a year-over-year basis, because the inventory of homes for sale is lower than historically normal levels. Inventory is up from year-ago levels, but supply is still tight in many markets because many would-be sellers with low mortgage rates are unwilling to sell and take on a higher rate to buy a different home."