So what can you disclose? If it isn't disclosed in the MLS? It sounds like Arkansas on being a disclosure state. A corporation doesn't have to disclose the sales price under certain circumstances. If not disclosed, then if not in the MLS, as far as I go, those sales don't exist. I would never put them in a grid, certainly not as ghost comps, and I would only point out that other sales exist but couldn't be confirmed due to the efforts of buyers to hide the sales price. Seems pointless to research a sale you cannot actually use.

No.

Having said that then the state is amiss to simply force them to disclose all such sales regardless of status. The alternative is for the state to make a clear over-valuation and force them to prove they didn't pay that much.

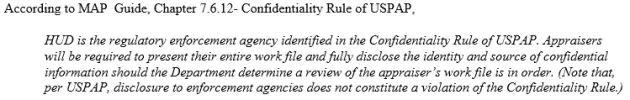

Terrel, I show the actual sale price, cap rate, and date of sale. However, I remove any identifying characteristics including going so far as obscuring physical indicators, for example: if it was built in 2003 I would say that it was built in the "2000s", if it has 178 units I would say that it has "150-200" units, if it was located in Euclid, OH, I would say "Cleveland MSA". I do have to make a decision when it comes to concluding to a $/unit so I would probably choose to use 175 or 180 and state in my comparable data sheet that the $/unit isn't exact but within a few % of the actual $/unit. My clients have no problem with me doing this and, in fact, many like it because the confidential sale is often something I appraised for them previously and if they know the date and sale price, they can figure out that I used a legit sale, but respected their borrower's confidentiality request. So everyone is happy. The issue here is that HUD wants to force my hand.

Ohio does mass valuation, stratified based on property class or some other differentiator. Properties are reappraised every 6 years with an updated every 3 years. LLC transfers are a way around disclosing the sale to the assessor (aka auditor in Ohio). Instead of a traditional real estate transaction, it is listed as a business transaction. The buyer buys the LLC in which the property, Great Apartments, is the only asset. So the ownership of the asset doesn't technically change, ie if Great Apts LLC is sold from person A to person B, it is still owned by Great Apts LLC as far as the assessor is concerned and no real estate sale has taken place. Now everyone in the know, knows that Great Apartments sold from person A to person B, but they want it confidential to keep the school and county, none the wiser. To uncover the sale, the school board/their attorney look at new mortgage filings. If they suspect that it is for a sale, they will subpoena the lender to get a copy of the appraisal. Then, with appraisal in hand, they subpoena me/the appraiser to testify. If they get that far, they either force a settlement or they fight until they win, . . . and they (the school) does win per a 1Q 2020 ruling by the Ohio Supreme Court. What are the odds of getting caught by the school board by using an LLC transfer? Not sure, but some owners hope to "slip one past the goalie" and do so successfully, but for them to have any shot of that, they demand that any data regarding their sale remain confidential.