Fernando

Elite Member

- Joined

- Nov 7, 2016

- Professional Status

- Certified Residential Appraiser

- State

- California

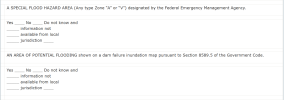

Why make appraiser the expert?What don't you understand here? You are appraising "the entire site". The lenders flood determination covers "the improvements" which might require flood insurance. You don't require flood insurance on raw land, there is nothing to be rebuilt if it floods. It's just easier for the lender to pressure the appraiser to change the first page of their appraisal than it is to go through the additional documentation steps required when the appraisal doesn't match the flood certification. You were manipulated. I was in a continuing education class one time when the instructor told the tale of a 10 acre site where the appraiser did precisely as you did. Later, the borrower decided to build a nice shop down by the dry creek bed where all the pretty trees were. Of course, it was washed away shortly thereafter. She pulled out her appraisal where it clearly indicated that her property was not located in a flood hazard zone and the appraiser (along with the lender) were sued because she contended that she would have never bought that property if she knew that she didn't have full use of the entire 10 acres. Not sure how that one turned out, however, think about that the next time you decide to offload your responsibilities onto a third party.

All appraiser had to do was make comment on what FEMA maps indicate on subject and what 3rd party Flood Company indicates.

And mentioned that client wanted to override FEMA. Put disclaimers that we are not flood experts.