I never said the adjusted range was not important. I already said I agree with you in most cases. You're asking about other cases, so I'm explaining. I can give you more examples too. I can probably drum some up from the real world. It happens not infrequently in rural and high-end markets.

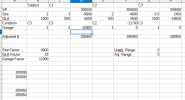

You still don't understand, so I’ll give you a visualization to help you better.

View attachment 92199

How much would you tinker with sensitivity in order to tighten this up? Would you make the garage stall adjustment $12,400? Or would you reduce the GLA adjustment to $35/sf first? At a certain point, this is overfitting. Are you saying my adjustments are incorrect because they don't narrow the range? Sensitivity analysis is not meaningless. But may not be as useful in certain scenarios and can be susceptible to overfitting.