- Joined

- Jun 27, 2017

- Professional Status

- Certified General Appraiser

- State

- California

Progress on getting R Earth to generate models on a level with Salford Systems MARS.

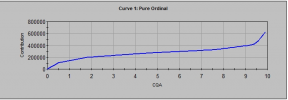

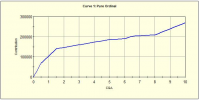

I have a data set that I created for a recent Estate Appraisal in Montara that was difficult. I had to use bootstrapping with MARS to get an GCV-R2 up to 0.85.

The best I could do with earth was an R2 of about 0.55 with 1 interaction and 0.64 with 2 interactions. However, Stephen Milborrow also, in addition to the September 2020 update to earth, a paper also from September called "Variance Models in Earth", that discusses a new parameter to earth called "varmod.method". Using this parameter I was able to generate a very nice model with an GCV-R2 of 0.86.

This means, everyone can do Mars with free software.

And, believe me, I am very sure the method I have proposed for the Sales Comparison Approach will become the standard.

I'm putting together a small paper that I will put up on the webiste tonight. Let you know in a subsequent post.

BTW, one of the members sent me an email a couple of days ago about when I was coming out with a book on the method. And this obstacle was the reason I put it off. I can't think of any appraisers willing to fork over $16K for statistics software. And the old earth in particular, often did not produce good models on difficult data. So after finishing the Montara appraisal Sunday, I decided to dig back into the latest on R earth:

I have a data set that I created for a recent Estate Appraisal in Montara that was difficult. I had to use bootstrapping with MARS to get an GCV-R2 up to 0.85.

The best I could do with earth was an R2 of about 0.55 with 1 interaction and 0.64 with 2 interactions. However, Stephen Milborrow also, in addition to the September 2020 update to earth, a paper also from September called "Variance Models in Earth", that discusses a new parameter to earth called "varmod.method". Using this parameter I was able to generate a very nice model with an GCV-R2 of 0.86.

This means, everyone can do Mars with free software.

And, believe me, I am very sure the method I have proposed for the Sales Comparison Approach will become the standard.

I'm putting together a small paper that I will put up on the webiste tonight. Let you know in a subsequent post.

BTW, one of the members sent me an email a couple of days ago about when I was coming out with a book on the method. And this obstacle was the reason I put it off. I can't think of any appraisers willing to fork over $16K for statistics software. And the old earth in particular, often did not produce good models on difficult data. So after finishing the Montara appraisal Sunday, I decided to dig back into the latest on R earth: