Good topic- suggestion - the title should be the NEW home market ( not just the market ), or stop propping up new home prices -

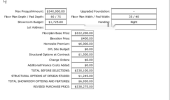

I have often wondered why this is allowed,, and what regulation would stop it - I have addressed this before wrt builder "preferred financing," which can be the lender who financed the project or a lender the builder owns -consider maybe a large % of homes in development is financed by it - the builder offers a borrower paid closing costs or perks such as a "free" upgrade package - and the appraisals just rubber stamp the price, especially the first original sales and each sale is then used by a valuation or appraisal as the comps