RSW

Elite Member

- Joined

- Feb 18, 2002

- Professional Status

- Certified Residential Appraiser

- State

- Tennessee

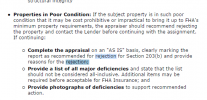

You always do HUD REOs AS IS. That I know. I am going to find the reference in the old material when I get the chance. If you will see in the post I posted from the 4000.1, It says "The property is being recommended for rejection. That same working was in the revised appendix D in the 4150.2.@RSW,

I think you are misunderstanding the protocol. The only time you do an as-is appraisal for a property that has $5000 or more in repairs is an REO/PFS property. The $5000 is in reference to the Insurability/Escrow statement specifically for REO properties. FHA appraisers do not make the same "escrow" statements for FHA purchases, refinance, etc. That is what the old handbook says. 4000.1 on the other hand increased that amount to $10,000, but again that only pertains to REO properties.

If it is for a purchase or refinance any deficiency that does not meet FHA MPR/MPS will require repair regardless if it costs $50, $5000 or $10,000 plus - unless a property is rejected. Properties that are rejected are typically homes that are affected by extreme conditions (example) ... sites where the soil and the home are contaminated with nuclear waste or homes in need of so many repairs that the economic life expectancy would be less that the life of a 30 year mortgage.

Neither of these things sound like what the OP described. The pipes will have to be repaired before the lender can secure an FHA loan. It does not matter who repairs it, as long as it gets repaired before closing so the appraisal will have to be done as-repaired as I suspected. Like I said, the listing agent should have known this would not have pased FHA. Quite frankly, OP should have known this would not pass FHA requirements. Would have saved a lot of headache and extra work.

It says nothing there about it being an REO appraisal. There are 5 situations where an AS IS appraisal can be done. You need to read a little better.

Last edited: