Fannie patting itself on their back for DEI:

"The 2022 Equitable Housing Finance Plan Performance Report

21

• Black borrowers refinancing their home on average received a slightly lower appraisal value

relative to automated valuation models.

• Homes owned by white borrowers were more frequently overvalued than homes owned by Black

borrowers.

• Six states, including Georgia, Louisiana, South Carolina, North Carolina, Mississippi, and Alabama,

accounted for nearly 50% of the overvalued homes of white owners in majority-Black

neighborhoods.

This research has helped inform Fannie Mae’s efforts to increase the number of accurate and unbiased

appraisals lenders submit to help remedy the legacy of racial inequities in the housing market. The

working paper concluded that modernizing the appraisal process, as well as fostering diversity in the

appraisal workforce, are two ways the housing industry can help minimize the chance of racial bias in

home valuation.

....................

Action: Execute SPCP Pilots to help support the expansion of homeownership eligibility and

availability of down payment assistance (DPA), while exploring ways to reduce SPCP

participation hurdles for lenders.

Action: Execute SPCP Pilot to support the reduction of borrower closing costs for Black

homebuyers via appraisal products, appraisal reimbursements, and/or title products.

....................

In 2022, Fannie Mae engaged with over 600 aspiring appraisers working through the National Urban

League’s affiliate Entrepreneurship Centers, hosting seven workshops and eight higher education

outreach events (including five historically Black colleges and universities (HBCU)). ADI awarded 330

scholarships, exceeding our goal by 65%. (Complete demographic data on the awardees is not available.)

ADI also secured 11 new industry sponsors, exceeding the goal of five new sponsors in 2022. This brings

the total ADI sponsors to 20."

...............

The Collateral Underwriter® (CU®) undervaluation flag, a new awareness data point that complements the

CU overvaluation flag, was released on June 24th.

The undervaluation flag is an additional tool to help

lenders identify and investigate potential misvaluation. If an appraisal is flagged as potentially

undervalued, lenders are notified and can then choose to review the appraisal. The flag is not evidence of

an undervaluation but is a cue to lenders to review appraisals as potentially inaccurate or incomplete.

The undervaluation flag is still in its early stages, and we continue to evaluate ways to make it a more

effective tool for lenders to identify potentially inaccurate appraisals."

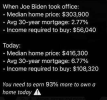

Neverrmind that the income required to buy the 'average' home has gone for $46,000 to $100,000, mostly because of poor government policy decisions.

The GSEs are taking the consumer to the cleaners. Talk about market interference. The smearing and disinformation of appraisers continue.

The GSEs are taking the consumer to the cleaners. Talk about market interference. The smearing and disinformation of appraisers continue.