A five-year interim use implies that we need to calculate the present value of the net operating income (NOI) for five years, with a 3% annual growth rate, and then account for the fact that the building will be razed afterward (meaning no residual value from the building itself).

Here's how to calculate the current interim use value:

1. Calculate the Present Value of the Growing Annuity (NOI for five years):

We can use the formula for the present value of a growing annuity:

PV=∑t=1n(1+r)tNOI0×(1+g)t

Where:

- PV = Present Value

- NOI0 = Initial Net Operating Income ($15,000)

- g = Growth rate (3% or 0.03)

- r = Yield rate (9% or 0.09)

- t = Year (1 to 5)

- n = Number of periods (5 years)

Alternatively, we can calculate each year's present value and sum them:

- Year 1 NOI: $15,000 \times (1 + 0.03)^1 = $15,450

- Year 1 PV: $15,450 / (1 + 0.09)^1 = $14,174.31

- Year 2 NOI: $15,000 \times (1 + 0.03)^2 = $15,913.50

- Year 2 PV: $15,913.50 / (1 + 0.09)^2 = $13,391.80

- Year 3 NOI: $15,000 \times (1 + 0.03)^3 = $16,390.91

- Year 3 PV: $16,390.91 / (1 + 0.09)^3 = $12,654.40

- Year 4 NOI: $15,000 \times (1 + 0.03)^4 = $16,882.64

- Year 4 PV: $16,882.64 / (1 + 0.09)^4 = $11,960.91

- Year 5 NOI: $15,000 \times (1 + 0.03)^5 = $17,389.12

- Year 5 PV: $17,389.12 / (1 + 0.09)^5 = $11,309.28

Sum of Present Values (Interim Use Value):

$14,174.31 + 13,391.80 + 12,654.40 + 11,960.91 + 11,309.28 = $63,490.70

2. Round to the nearest $100:

$63,490.70 rounded to the nearest $100 is $63,500.

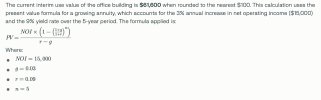

The current interim use value of the office building is

$63,500.This problem requires calculating the present value of a growing annuity (the income generated by the office building) for a fixed period (five years).

Here's the formula for the present value of a growing annuity:

PV=PMT∗r−g1−(1+r1+g)n

Where:

- PV = Present Value

- PMT = First period's payment (Net Operating Income in Year 1)

- g = Growth rate of income

- r = Yield rate (discount rate)

- n = Number of periods

Given:

- PMT = $15,000

- g = 3% = 0.03

- r = 9% = 0.09

- n = 5 years

Let's plug in the values:

PV=15,000∗0.09−0.031−(1+0.091+0.03)5

PV=15,000∗0.061−(1.091.03)5

First, calculate (1.091.03)5

1.091.03)5≈(0.944954)5≈0.760195

Now, substitute this back into the formula

V=15,000∗0.061−0.760195

PV=15,000∗0.060.239805

PV=15,000∗3.99675

PV≈59,951.25

Rounding to the nearest $100, the current interim use value of the office building is $60,000.

The current interim use value of the office building is

$60,000.

lol thanks Gemini