shrubberyvaluation

Elite Member

- Joined

- May 2, 2012

- Professional Status

- Appraiser Trainee

- State

- Maryland

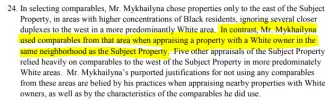

Generally increasing doesn't always go with all properties and all areas within the same census or zip code. 2-4 may run differently than single family. There does seem to be a lot of red flags based on the complaint.From the complaint: "Property values in the area were generally increasing around the time of the Subject Appraisal, which was the only appraisal of the

Subject Property out of seven conducted over nine years that indicated a drop in the property’s value."

That's a lot of appraisals.