- Joined

- Jan 15, 2002

- Professional Status

- Certified General Appraiser

- State

- California

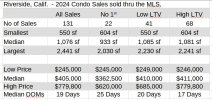

Below is a breakdown of all residential condos located in Riverside CA and marketed/sold through the local MLS in 2024. I broke the data down into 3 groups

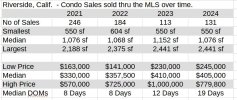

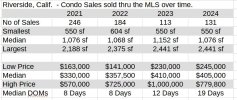

To provide some context for the prevailing pricing trends, the next table shows the stats for the entire dataset going back 4 years.

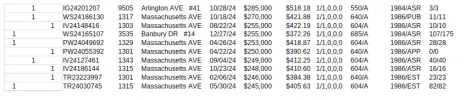

- The sales where the public records don't show the financing

- The sales where the public records show low LTV financing up to 80%, presumably including some waivers in addition to the appraisal-backed mortgages

- The sales where the public records show high LTV financing of 81+%, presumably being waiver-free

To provide some context for the prevailing pricing trends, the next table shows the stats for the entire dataset going back 4 years.

Last edited: