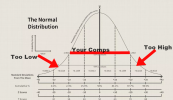

No set of numbers can escape being analyzed for its statistical attributes. There is no statistical value except to determine is a set of numbers are random or not. If not random, then the set is amicable to analysis of its statistical properties. You don't simply use some sale because of its properties even though it is well below the typical range of prices. You analyze why it is low and even if you cannot determine a reason, you reject it as out of the ordinary ("typical") range and you do the same for those above the typical range. "Most Probable" implies an adjusted price that is the median sale - that is a price that is equally likely to fall below or above that value.

Yes, appraisers or reviewers or both can use statistics to analyze the market.

But these are not numbers, they are prices, and prices can be off of what the MV concept is - which is why an appraisal is done.

Numbers can be random, but prices are not random. I agree not to use outliers well above or well below the typical range, but that is because of market-based reasons, not statistical reasons.

Most probable was inserted to replace the former "highest most probable price." Most probable means the most likely price for a specific property, which is not always the median price or median sale price of a comparable.

Some properties deserve a higher price as the most probable, and some properties deserve a lower price as the most probable, and some deserve a middle price, depending on the subject's qualities as well as market trends. When I say deserve, I mean supported by the appraisal which uses actual sales and supply/demand in the market. Why underappraise or overappraise a property just to see a safe middle ground?

Why would the most upgraded property or the least upgraded property both get the same median sale price value in an appraisal? It makes no sense when people pay more for upgraded houses, and the subject (for example ) is closer in upgrades to the most upgraded sale comp, which also sold for the highest price.