Mile High Trout

Elite Member

- Joined

- Feb 13, 2008

- Professional Status

- Certified Residential Appraiser

- State

- Colorado

Looks like this is a two poster, soo long.

Well, having read a substantial volume of posts here, thought I'd chime in with a slightly different take. Apologies if others have covered these points, and I know several appraisers did cover what I'm about to post in part. Through many responses I had said, yes, that is what needs to be considered, agreed, etc.

Who's to blame is the entire AMC industry for changing the engagement modeling regarding appraisers performance and workflow availability standards. It's important to understand that the very basic frameworks of GSE guidance and subsequent individual lenders underwriting guidelines standards which often mirror GSE guidance and add to that, the entire framework was based on an older model of engagement before AMC's captured over 85% of all lending work which required an associated appraisal.

How it used to work was the individually licensed mortgage banker or mortgage broker would call their trusted appraiser and ask for a comp search, to check if potential value needs to form a loan around could be met. Or in the case of sales, as soon as a sales event was being formed and a contract in hand, the broker would immediately form an appraisal request. The important factor here is time. Because the appraiser was engaged at the earliest stages of mortgage loan package formation, the appraiser had adequate time to perform key actions; 1. Schedule in the request in a way which allowed for quality appraisal performance, careful consideration, and even some additional time for preponderance and reflection if complex issues existed. We used to routinely have deadlines which were anywhere from two weeks to eight weeks away for just about every order. Where I started our target turn time we'd ask from lenders was four weeks. This ties into the second important consideration. 2. Workflow reliability. Because the mortgage banker and the appraiser had formed a business relationship with at least a basic level of trust in each others performance standards, the appraiser would not live in fear that if they made one little error, had to charge more for a complex situation, ran a borrower through additional inspection hoops, or ran a day late, the appraiser would not have to worry about grading, performance metrics, and future loss of work. I like to refer to this as; If the appraiser is good enough to be on a lenders approved appraisers panel, they should expect a fair share of work.

Then the AMC's came around. They began grading appraisers based on meaningless performance metrics which were contrary and inhibiting to the very nature of quality appraisal practice. Due to the improperly co mingled AMC and appraisers fee, the AMC companies then had a financial incentive to push the appraisers for faster turn times so the AMC could make more money. But even more importantly the AMC's then had a financial incentive to select the lower priced appraisers to increase their profit margins. Then like a light switch the industry changed. Suddenly there were typist service firms, more runners and sub standard industry workers whom did not have a clue about what appraisal was, the importance of careful consideration, nor did they understand why an appraiser would take all this time to get what appeared to be a simple report done. Because AMC's are basically ready to go out of the box telecom companies, they have higher employee turnover, and typically are not employing qualified professionals whom under stand real estate. They understand time management and phones, order processing, simple stuff. Because these peoples own positions are modeled on time and simple performance metrics (anyone who's worked at a telecom will understand how they grade you on every last detail down to the very minutes and seconds), they thought this was a meaningful way to grade appraisers. Because they were not qualified to complete the appraisal task themselves, they turned to something familiar to judge the competency of the appraiser instead. Time. Cost. Efficiency. Accuracy. The ability to get the job done with the least amount of complications or questions. They judged the appraiser almost exclusively based on time, and the appraisers ability not to make waves or upset anyone. Then among the fasted appraisers, they selected what they call 'top tier', 'elite', or 'proffered appraisers', based on their lowest fee. In the AMC realm they appeared to have solved key concerns about appraisers higher costs and longer turn times; Now they have limited perceived excessive service fees, and increased service efficiencies. Appraisers whom did not meet these two key standards; speed and lower cost, were cut out of the loop and received no work. That's why prior to HVCC and subsequent DF RegZ separation from mortgage loan production rule, most appraisers would work with GSE's on FRT's, but then after these rules were implemented literally half of all appraisers now refused to provide service in the GSE realm for FRT's. But the AMC's were able to report to lenders about the faster turn times and lower costs. The illusion of quality service was established. The illusion of the value of AMC's management injection was confirmed. They were doing something good for lenders and training appraisers to do better.

But in the real world that's not what the end result of the AMC industries injection really played out. The AMC industry broke several key elements which appraisers must have to provide quality service. The appraiser must have a reliable work flow in order to have adequate resources to tackle difficult work. The appraiser must have reliable work flow to train the next gen of appraisers. The appraiser must have adequate income in order to sustain the business and make the work worthwhile from a business owners/managers perspective. AMC's took that away over night. So what is the real problem you may ask? The problem is that appraisers whom cut the most corners, moved faster then others, they were rewarded with the lions share of work orders. There was no more fair distribution aka round robin distribution of appraisal work requests. Behind the scenes appraisers were required to change their methods such as having enough time, instead time constraints and pressure. The fear of losing your entire business if one does not perform with these 24/48/72 hour turn time expectations. Being required to lie to borrowers and keep the appraisers fee a secret, to no longer include invoices with reports as had been the industry standard (and still is for non FRT work). These time constraints also limited appraisers ability to have diverse client bases which further reduced appraisers independent positions, as they became virtual employees of the AMC, subservient to their cause. If an appraiser upsets any single person at an AMC they don't just lose one lender, they lose all the lenders that AMC is contracted with, forever. A totally different model then being able to set an individual mortgage broker straight, then turn around and call the one sitting next to them and get ones work flow from them instead. Or in other similar modeling, the ability to switch which lender the appraiser preferred to work with. Then we get into other outsourced services such as remote typing services, cut and paste regurgitated writing material which was not unique, inspection runners, and less then stellar appraiser office staff. Instead of a full day if not two to complete a tough appraisal, the appraiser now had mere hours per each. The AMC appraisers were no longer training independent professionals, they were now training expedient efficient service workers whom only had one gear speed; fast and cheap. Again, a totally different model then before AMC's were involved.

Well, having read a substantial volume of posts here, thought I'd chime in with a slightly different take. Apologies if others have covered these points, and I know several appraisers did cover what I'm about to post in part. Through many responses I had said, yes, that is what needs to be considered, agreed, etc.

Who's to blame is the entire AMC industry for changing the engagement modeling regarding appraisers performance and workflow availability standards. It's important to understand that the very basic frameworks of GSE guidance and subsequent individual lenders underwriting guidelines standards which often mirror GSE guidance and add to that, the entire framework was based on an older model of engagement before AMC's captured over 85% of all lending work which required an associated appraisal.

How it used to work was the individually licensed mortgage banker or mortgage broker would call their trusted appraiser and ask for a comp search, to check if potential value needs to form a loan around could be met. Or in the case of sales, as soon as a sales event was being formed and a contract in hand, the broker would immediately form an appraisal request. The important factor here is time. Because the appraiser was engaged at the earliest stages of mortgage loan package formation, the appraiser had adequate time to perform key actions; 1. Schedule in the request in a way which allowed for quality appraisal performance, careful consideration, and even some additional time for preponderance and reflection if complex issues existed. We used to routinely have deadlines which were anywhere from two weeks to eight weeks away for just about every order. Where I started our target turn time we'd ask from lenders was four weeks. This ties into the second important consideration. 2. Workflow reliability. Because the mortgage banker and the appraiser had formed a business relationship with at least a basic level of trust in each others performance standards, the appraiser would not live in fear that if they made one little error, had to charge more for a complex situation, ran a borrower through additional inspection hoops, or ran a day late, the appraiser would not have to worry about grading, performance metrics, and future loss of work. I like to refer to this as; If the appraiser is good enough to be on a lenders approved appraisers panel, they should expect a fair share of work.

Then the AMC's came around. They began grading appraisers based on meaningless performance metrics which were contrary and inhibiting to the very nature of quality appraisal practice. Due to the improperly co mingled AMC and appraisers fee, the AMC companies then had a financial incentive to push the appraisers for faster turn times so the AMC could make more money. But even more importantly the AMC's then had a financial incentive to select the lower priced appraisers to increase their profit margins. Then like a light switch the industry changed. Suddenly there were typist service firms, more runners and sub standard industry workers whom did not have a clue about what appraisal was, the importance of careful consideration, nor did they understand why an appraiser would take all this time to get what appeared to be a simple report done. Because AMC's are basically ready to go out of the box telecom companies, they have higher employee turnover, and typically are not employing qualified professionals whom under stand real estate. They understand time management and phones, order processing, simple stuff. Because these peoples own positions are modeled on time and simple performance metrics (anyone who's worked at a telecom will understand how they grade you on every last detail down to the very minutes and seconds), they thought this was a meaningful way to grade appraisers. Because they were not qualified to complete the appraisal task themselves, they turned to something familiar to judge the competency of the appraiser instead. Time. Cost. Efficiency. Accuracy. The ability to get the job done with the least amount of complications or questions. They judged the appraiser almost exclusively based on time, and the appraisers ability not to make waves or upset anyone. Then among the fasted appraisers, they selected what they call 'top tier', 'elite', or 'proffered appraisers', based on their lowest fee. In the AMC realm they appeared to have solved key concerns about appraisers higher costs and longer turn times; Now they have limited perceived excessive service fees, and increased service efficiencies. Appraisers whom did not meet these two key standards; speed and lower cost, were cut out of the loop and received no work. That's why prior to HVCC and subsequent DF RegZ separation from mortgage loan production rule, most appraisers would work with GSE's on FRT's, but then after these rules were implemented literally half of all appraisers now refused to provide service in the GSE realm for FRT's. But the AMC's were able to report to lenders about the faster turn times and lower costs. The illusion of quality service was established. The illusion of the value of AMC's management injection was confirmed. They were doing something good for lenders and training appraisers to do better.

But in the real world that's not what the end result of the AMC industries injection really played out. The AMC industry broke several key elements which appraisers must have to provide quality service. The appraiser must have a reliable work flow in order to have adequate resources to tackle difficult work. The appraiser must have reliable work flow to train the next gen of appraisers. The appraiser must have adequate income in order to sustain the business and make the work worthwhile from a business owners/managers perspective. AMC's took that away over night. So what is the real problem you may ask? The problem is that appraisers whom cut the most corners, moved faster then others, they were rewarded with the lions share of work orders. There was no more fair distribution aka round robin distribution of appraisal work requests. Behind the scenes appraisers were required to change their methods such as having enough time, instead time constraints and pressure. The fear of losing your entire business if one does not perform with these 24/48/72 hour turn time expectations. Being required to lie to borrowers and keep the appraisers fee a secret, to no longer include invoices with reports as had been the industry standard (and still is for non FRT work). These time constraints also limited appraisers ability to have diverse client bases which further reduced appraisers independent positions, as they became virtual employees of the AMC, subservient to their cause. If an appraiser upsets any single person at an AMC they don't just lose one lender, they lose all the lenders that AMC is contracted with, forever. A totally different model then being able to set an individual mortgage broker straight, then turn around and call the one sitting next to them and get ones work flow from them instead. Or in other similar modeling, the ability to switch which lender the appraiser preferred to work with. Then we get into other outsourced services such as remote typing services, cut and paste regurgitated writing material which was not unique, inspection runners, and less then stellar appraiser office staff. Instead of a full day if not two to complete a tough appraisal, the appraiser now had mere hours per each. The AMC appraisers were no longer training independent professionals, they were now training expedient efficient service workers whom only had one gear speed; fast and cheap. Again, a totally different model then before AMC's were involved.

Attachments

-

AMC fee pressure.JPG89.5 KB · Views: 6

AMC fee pressure.JPG89.5 KB · Views: 6 -

TSI 2010.JPG216.2 KB · Views: 5

TSI 2010.JPG216.2 KB · Views: 5 -

SWBC AMC 2016.JPG200.9 KB · Views: 4

SWBC AMC 2016.JPG200.9 KB · Views: 4 -

Streetlinks 2010.JPG218.2 KB · Views: 4

Streetlinks 2010.JPG218.2 KB · Views: 4 -

stewart 2024.JPG128 KB · Views: 4

stewart 2024.JPG128 KB · Views: 4 -

NREIS 2008.JPG137.3 KB · Views: 5

NREIS 2008.JPG137.3 KB · Views: 5 -

MAM members appraisal management AMC 2015.JPG106.2 KB · Views: 4

MAM members appraisal management AMC 2015.JPG106.2 KB · Views: 4 -

Landmark AMC 2015.JPG173.8 KB · Views: 4

Landmark AMC 2015.JPG173.8 KB · Views: 4 -

First American, 2022 terms.JPG163.6 KB · Views: 3

First American, 2022 terms.JPG163.6 KB · Views: 3 -

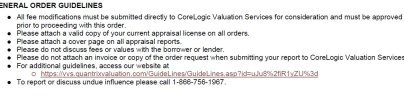

corelogic quantrix 2010.JPG78.4 KB · Views: 5

corelogic quantrix 2010.JPG78.4 KB · Views: 5