- Joined

- Mar 11, 2008

- Professional Status

- Certified Residential Appraiser

- State

- Texas

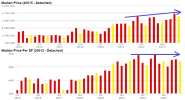

Of course - because of the heterogeneity of the data. $100k home situated next to a $1M home. And even when you do filter for variability, the remaining 'competing' data set is often so small that outliers skew any trend analysis. My prediction is that this new rule is not going to be much of a burden on those folks who have relatively large competing property data sets. It's gonna be like writing a book for the rural guys who are trying to quantify trends...A predominately rural MLS will suffer wild swings in data

View attachment 95849View attachment 95850