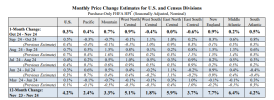

How are we going to expect GSE appraisers to do a credible high-level analysis when the MAI educators teaching it don't understand it? My interaction with employees at the GSEs tells me many of them don't understand it either. I know we've both said it, but I'll say it again... GSEs seem to be more interested in having appraisers validate their multi variable regression models than they are in encouraging appraisers to think and analyze markets critically. I have a feeling these changes will result in some lenders preferring incorrect but well-documented time adjustments from software (such as those shown in posts 84/85) as opposed to credible but less well-documented time adjustments based on old school methods of analyzing the underlying fundamentals along with sensitivity, pairs, resales, pendings, and agent interviews.

Seasonal fluctuation in prices occurs in a stable market where you would not adjust a December sale to April, despite the trendline moving in that direction. This means using a trendline to determine the adjustment is often going to be incorrect, because the correct adjustment is $0. This is why it's important to understand whether it is seasonal (i.e. compositional) or whether prices are actually changing.

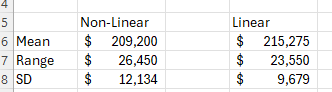

I see two different issues. First it whether linear vs. polynomial is better, the second is whether regression captures the true drivers of price change in the first place. Swapping a 3rd‐order polynomial for a linear slope isn't going to produce a much better result, because in both cases the data is unadjusted for property differences. If the data are not controlled for transaction and property differences, then the regression is not a better analysis. It's just a fancy‐looking chart to appease the UW. I'm not trashing regression at all because I use it all the time. But it's not the end all be all, it has weaknesses that if you are gonna use it you should understand.