Terrel, I have never argued that the use of qualitative methods and analysis is wrong...in fact I acknowledge that qualitative analysis is a vital part of the appraisal process. However, whenever an appraiser makes an adjustment (a change) to the sale price of a comp to account for the difference(s) in property attributes between the comp and the subject property, that is a quantitative adjustment. Now it is possible that the appraiser used qualitative analysis to inform his opinion on the amount of the adjustment, but the adjustment itself is quantitative.

FYI, the my version of the

The Appraisal of Real Estate is the 15th edition and somewhere around here I still have a 13th edition....unfortunately I don't have a copy of the 10th edition handy. Also, my copy of

The Dictionary of Real Estate Appraisal is the 7th edition for your reference.

In any case, here is what the 15th edition of

The Appraisal of Real Estate has to say on the same subject:

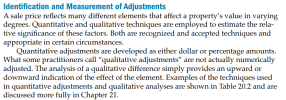

View attachment 97625

The key language from the above is "what some practitioners call 'qualitative adjustments' are not not actually numerically adjusted. The analysis of a qualitative difference simply provides an upward or downward indication of the effect of the element."

This supports my view that qualitative analysis is not an adjustment and that an adjustment made to the sale price of a comparable sale, is, by definition, quantitative. However, that does not mean that I do not think that qualitative analysis is a legitimate and vital tool in the appraiser's toolbox.

This disagreement stems from the fact that some appraisal practitioners do not have a good understanding of the terms "quantitative" and "qualitative" or "adjustments" as those terms apply to the appraisal profession.