- Joined

- May 20, 2011

- Professional Status

- Certified General Appraiser

- State

- Minnesota

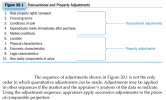

Theoretically, seller concessions and any expenses made immediately after purchase should be accounted for first to make it cash equivalent. Then you apply the market conditions adjustment to that cash equivalent adjusted sale price. Only after the sale is made cash equivalent and current do you start adjusting for physical differences (site and improvements). If you go out of order you'll get a different result, which is typically a rounding error in most residential assignments.