NJAPRAZE

Junior Member

- Joined

- Jun 15, 2007

- Professional Status

- Certified Residential Appraiser

- State

- Pennsylvania

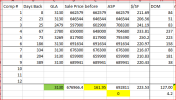

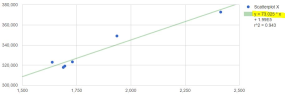

anyone use single / linear regression analysis for determining GLA adjustment (after netting out site and then using cost/sf as the independent variable)?

thoughts on reliability and process?

thoughts on reliability and process?