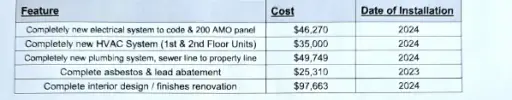

This is a multi family because it says 1st & 2nd floor units? Nobody understands that form. How did you change the value without changing the other values, price per unit, price per bedroom, grm etc. If you have a friendly lender, it's not a problem changing something. Changing a value because you got new info is a good excuse. But the extra costs you got shouldn't have really affected the value. These are unseen things, you didn't take into account that every thing was done to c2 condition, regardless of the costs, originally when you inspected.

I don't understand why the additional costs made a difference on a c2 property. That's my review concern. It looks like a pressure bump up to me. You said in the original report that he gutted the property. So it's a c2, the cost to rehab is the same cost to rehab as for any other other comps. I do not understand why the new increase in value, c2 is c2 regardless how much it cost, or how much you overdid it. You didn't know that a c2 rehab includes the items that you say newly increased the value. I'm dinging you if i'm the state. But maybe loving you if i'm the lender.