- Joined

- Sep 20, 2005

- Professional Status

- Licensed Appraiser

- State

- Virginia

Sounds like SML. I also believe you have two different market participants in your scenario. How does your "average" for the season work out on an annual basis?Meaningless huh? Hummm... There is a large lake that is in two counties. Located on opposite sides of the lake, within sight, are two similar houses. They are in different counties, one allows short term rentals and the other does not. As an investor I can invest in one and hope for around $2500 to $5000 per month rental income. The other will bring me that much per week, maybe weekend during the season. Which one will I pay more for? This is not fictional or far fetched. I'm less than an hour from that lake and see this all the time. Now, after several of the STR properties sell, then you have market data supporting that indeed STR's do affect value.

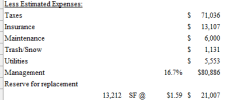

What is the OPEX for one versus the other?

Also, if it is SML you have a different clientele. The south side of the lake draws clients from Greensboro and Winston Salem. The north side of the lake is more Roanoke, Lynchburg and maybe Charlottesville.

Last edited: