-

Welcome to AppraisersForum.com, the premier online

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Solar panels

- Thread starter Zsa Zsa

- Start date

- Status

- Not open for further replies.

- Joined

- May 2, 2002

- Professional Status

- Certified General Appraiser

- State

- Arkansas

Solar panels are either owned and attached (fixture), or they are lease to own, and attached (trade fixture). Fixtures are real property. Trade fixtures are private property

Ideally there should be a strict relationship between the income savings of a solar array and the value thereof. Since there is some market resistance to the panels by a significant portion of the buyers, it is likely a functional obsolescence accrues to the panels, in other words the income savings capitalized by some means does not necessarily resolve itself into an exact equal of a contributory value in sales.

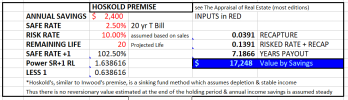

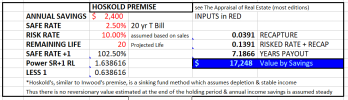

Thus, the income approach to be accurate must be judged against an extracted value in exchange. That's the hardest thing. OTOH, it is certainly possible providing you have a few sales to extract a contributory value where you also can estimate the savings. In that case, a sinking fund calculation can be reversed to determine the safe+risk rate. I prefer Hoskold over Inwood but basically both do the same thing - a sinking fund calculation.

Ideally there should be a strict relationship between the income savings of a solar array and the value thereof. Since there is some market resistance to the panels by a significant portion of the buyers, it is likely a functional obsolescence accrues to the panels, in other words the income savings capitalized by some means does not necessarily resolve itself into an exact equal of a contributory value in sales.

Thus, the income approach to be accurate must be judged against an extracted value in exchange. That's the hardest thing. OTOH, it is certainly possible providing you have a few sales to extract a contributory value where you also can estimate the savings. In that case, a sinking fund calculation can be reversed to determine the safe+risk rate. I prefer Hoskold over Inwood but basically both do the same thing - a sinking fund calculation.

shrubberyvaluation

Elite Member

- Joined

- May 2, 2012

- Professional Status

- Appraiser Trainee

- State

- Maryland

Look to the market. Problem is just typically lack of data due to leased and financed panels on comps. A lack of owned panels does not mean they are not valued.

shrubberyvaluation

Elite Member

- Joined

- May 2, 2012

- Professional Status

- Appraiser Trainee

- State

- Maryland

Is the typical buyer making all those calculations at purchase?Solar panels are either owned and attached (fixture), or they are lease to own, and attached (trade fixture). Fixtures are real property. Trade fixtures are private property

Ideally there should be a strict relationship between the income savings of a solar array and the value thereof. Since there is some market resistance to the panels by a significant portion of the buyers, it is likely a functional obsolescence accrues to the panels, in other words the income savings capitalized by some means does not necessarily resolve itself into an exact equal of a contributory value in sales.

Thus, the income approach to be accurate must be judged against an extracted value in exchange. That's the hardest thing. OTOH, it is certainly possible providing you have a few sales to extract a contributory value where you also can estimate the savings. In that case, a sinking fund calculation can be reversed to determine the safe+risk rate. I prefer Hoskold over Inwood but basically both do the same thing - a sinking fund calculation.

View attachment 58679

- Joined

- May 2, 2002

- Professional Status

- Certified General Appraiser

- State

- Arkansas

It isn't that the data isn't there. It is separating the wheat from the chafe. Treasure those sales.Problem is just typically lack of data

Some do take into account the savings. But what I am pointing out is that you can extract that risk rate (or overall rate really) from those few sales you can confirm.Is the typical buyer making all those calculations at purchase?

You reverse the sinking fund calculation to solve for the overall rate by inputting the savings and the end value being what the market says it is.

So if you do 3 or 4 of these, you likely have a sinking fund rate of 20% more or less. You and extract the "safe rate" at the T Bill for a similar length life as you have calculated the remaining life... (If the total life of a solar panel is 30 years installed 10 years ago, then the remaining life hence T bill for 20 years is the right remaining life. Then the rest is the "risked rate" so you can apply that regardless the savings to estimate a contributory value. It beats guessing or doing a depreciated cost on the panels and it beats the L out of ignoring the panels completely.

sputnam

Elite Member

- Joined

- Apr 24, 2012

- Professional Status

- Certified General Appraiser

- State

- North Carolina

My opinion is that USPAP requires you to support all adjustments. You also need to be able to support a decision to not adjust for a difference between the subject and a comparable. If there is truly no market data to do either one, why do you think there should be any adjustment?

Mark K

Elite Member

- Joined

- Jan 27, 2004

- Professional Status

- Certified Residential Appraiser

- State

- Indiana

A lack of market data does not mean that an amenity has zero value. Unique features often have significant value. Terrel's approach is a supportable method of valuation absent market data.If there is truly no market data to do either one, why do you think there should be any adjustment?

It beats guessing or doing a depreciated cost on the panels and it beats the L out of ignoring the panels completely.

Including a depreciated cost approach and reconciling the two would add additional support for an adjustment, IMO.

- Joined

- May 2, 2002

- Professional Status

- Certified General Appraiser

- State

- Arkansas

Nothing in USPAP Std 1 says that. Don't conflate FNMA or FHA guidelines with USPAPMy opinion is that USPAP requires you to support all adjustments.

- Joined

- Jan 15, 2002

- Professional Status

- Certified General Appraiser

- State

- California

The resale values vary by locale. That means the local market conditions are an element of any income-based analysis.

sputnam

Elite Member

- Joined

- Apr 24, 2012

- Professional Status

- Certified General Appraiser

- State

- North Carolina

You're wrong. USPAP says that your conclusions and opinions are to be supported. An adjustment is a conclusion about the market reaction to differences in a particular feature.Nothing in USPAP Std 1 says that. Don't conflate FNMA or FHA guidelines with USPAP

- Status

- Not open for further replies.