J Grant

Elite Member

- Joined

- Dec 9, 2003

- Professional Status

- Certified Residential Appraiser

- State

- Florida

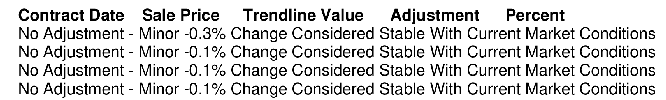

The FED can not even figure out the effect of inflation, let alone appraisers. Why go there - just stick to the basics - it is easy to run regression, charts or graphs or simply grid some comps and then check the most recent listings and spending. It will show either prices are going up ( or down) or they are stable. THE END.