- Joined

- May 22, 2015

- Professional Status

- Certified Residential Appraiser

- State

- Pennsylvania

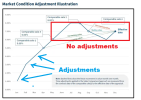

Beginning in February 2025, appraisers will be required to provide support for time value adjustments for comparable sales (comps) and market conditions—and also include an illustration of the methodology used.

If we can have a program that says and does this and puts in the numbers, life gets easier. If you have to figure out yourself all this and write it, no extra pay for extra time spent. Also, this is showing you that fannie has the program to burn you. And of course, their avm will have this. Another domino falls to end of appraisers.

If we can have a program that says and does this and puts in the numbers, life gets easier. If you have to figure out yourself all this and write it, no extra pay for extra time spent. Also, this is showing you that fannie has the program to burn you. And of course, their avm will have this. Another domino falls to end of appraisers.