In house banks are required to report both the "as is" and the "as competed" (or whatever) value. FDIC required, not secondary market.

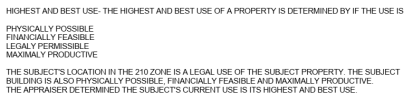

As for HBU, I think you are in danger of stretching the problem with an "as is" value is wanted. The question is which is more valuable - the property as it is, or as if vacant...in other words is the house a teardown.

HBU does not address creating a scenario of subdiving a property. The question is "as is" and that means what is the value of the lot in total if the house was not there. I did a series of houses in a small town where large lots were subdivided. 2 into 4 lots and 1 into 6 lots. They sold as individual large lots but after divided, they were worth more. But it is not correct HBU analysis to claim these single lots should be divided and value them accordingly. That is not "as is", it is "as planned" or whatever. In all 3 cases, curbs, utilities, surveys, and 2 streets were required to subdivide the lots plus the permits and approvals of the city. Then the houses were built and sold as individual lots.