(Well, I guess this discussion is more productive than arguing how many angles can dance on a head of a pin?)

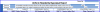

Here is the top of page 2:

The first question blank-space represents the number of sales or listings "in the subject's neighborhood". Two important concepts here:

A. If there are zero sales, then there is no range

B. Expanding the neighborhood to capture sales is not the expectation or correct procedure

Personally, I don't think it is a big deal to put a "zero" or leave empty the range-blanks. A simple comment will explain what action was taken and why.... and no one is being misled. This might be the best example of where "N/A" really is applicable.

If there are zero sales from within the subject's defined neighborhood from within the last 12 months, then two other things

should happen:

C. The report must supplement the analysis to develop a credible market-trend conclusion. This is when one would go to competing neighborhoods or analyze the larger market; to determine what the trend (declining, stable, increasing) is that affects the subject's property-type/submarket.

D. If there are zero sales within the defined neighborhood from within the last year, then this is the reason why (i) one should go back more than 12 months and that action shouldn't be questioned, and/or (ii) one should go out farther in distance to capture sales from competing neighborhoods and shouldn't be questioned.

Correctly completing the 1004MC, with all its flaws, when there are zero sales from within the subject's neighborhood, provides the most compelling reason for the report to do what some lenders/reviewers frown upon: go back further in time or go out farther in distance.

For the large majority of markets, the expectation is that there is some transaction activity of comparable sales within the last 12 months. When that is the case, it would be unexpected to go further back in time or out in distance without a very good reason ("Gee, Denis, you have 10 closed sales within your defined neighborhood that you've identified as comparable. Why'd you go back 1.5 years and outside of the neighborhood to get sales?").

However, when there are zero sales, then the expectation flips: One must go back in time or out farther in distance to capture sales that are comparable... they are just older than 12 months or located outside of the subject's neighborhood.