- Joined

- Jan 15, 2002

- Professional Status

- Certified General Appraiser

- State

- California

An error in public records or the subject's MLS listing is inclusive in what I'm referring to. And you HAVE run into such errors about the subject before. You just never spotted all of them. Not unless you're special from every other appraiser.an error on a comparable sale is not the same as an error on the subject property...but keep trying

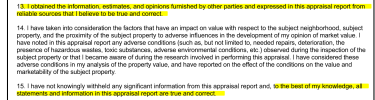

Besides, the appraiser's SOW is at the desktop and is clearly disclosed as such in those reports.