Bobby Bucks

Elite Member

- Joined

- Jan 27, 2002

- Professional Status

- Real Estate Agent or Broker

- State

- North Dakota

How Bitdeer is transforming bitcoin mining machines

Yeah, my ETH bag is getting absolutely demolished. I converted about 20% of it to SOL and TAO about a year ago, but wish I would have done more. The problem right now is all of the L2’s accrue little value to ETH, the L1 asset. When QT inevitably winds down in the next 1-3 months, I still think ETH will rip, but wow…it’s been absolutely brutal to hold. Still pulling in about $200-$250 in ETH per month via staking rewards, but…Bitcoin ETFs Go Back to Massive Outflows

What a difference a day makes, Cathie Wood’s ARK was buying more Bitcoin 2 days ago

Long term still looks good, still waiting for it to drop to the 70s, if I miss the train, I may have a long wait.The amount of Bitcoin rumors being posted on X is incredible. ETH needs some good news.

I used to worry about ETH killers, now I worry about Solana killers. The ETH maximalists must be miserable or having second thoughts. I still think they’re good for long term.Yeah, my ETH bag is getting absolutely demolished. I converted about 20% of it to SOL and TAO about a year ago, but wish I would have done more. The problem right now is all of the L2’s accrue little value to ETH, the L1 asset. When QT inevitably winds down in the next 1-3 months, I still think ETH will rip, but wow…it’s been absolutely brutal to hold. Still pulling in about $200-$250 in ETH per month via staking rewards, but…

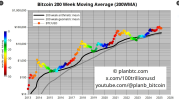

Yeah, I’m thinking the traditional 4 year Bitcoin cycle is over. BTC price is more tied to global liquidity than the halving of new supply of mined coins now, IMO. QT is starting to slow now, but still ongoing. Global liquidity has been on uptrend for 1-2 months, and BTC price generally lags liquidity changes by about 3 months. If liquidity starts exploding, we may actually see an alt coin season. We shall see.PlanB about 30 minutes ago on X.

Some are calling the bear market. I don't agree. The fact that Bitcoin’s 200-week arithmetic and geometric means have been close together for over a year indicates reduced volatility and steady sustained uptrend, doubling from $20k to $40k in 2023 and from 40k to $80k in 2024. What if this steady uptrend continues, from $80k to $160k in 2025, to $320k in 2026, to $640k in 2027 etc? Yes such a scenario would mean the end of the 4-year cycle, earlier than I expected tbh, but it would fit a more mature market. Also note: you can only have a real bear market (converging arithmetic and geometric means) after a real bull market (diverging arithmetic and geometric means) ... and there has been no real bull market.

View attachment 98081

Yeah, I’m thinking the traditional 4 year Bitcoin cycle is over. BTC price is more tied to global liquidity than the halving of new supply of mined coins now, IMO. QT is starting to slow now, but still ongoing. Global liquidity has been on uptrend for 1-2 months, and BTC price generally lags liquidity changes by about 3 months. If liquidity starts exploding, we may actually see an alt coin season. We shall see.

View attachment 96677

It's a nice pop but it's still trending down. Series of lower highs and lower lows.

You can see that there were similar pops in January only to move lower. Still looks like it's going lower to the bottom of the box around $200-$220 to me. You want to see it at least make equal highs and equal lows like July-Sept 2024 for signs of bottoming.

View attachment 97095

Sometime this year I think we are probably going to see a correction like 2015-2016. Probably grind for a little bit around highs and then see a sharp move lower down to the moving average. I don't know exactly when but I think we are going to see that this year. Market pretty much flat for the year.