Mejappz

Elite Member

- Joined

- Dec 16, 2005

- Professional Status

- Certified Residential Appraiser

- State

- Florida

Of course no mention of quality, qualifications, or experience. Geo competency, AMC fee, and turntimes, etc. If you don't hire qualified professionals you get what you pay for.

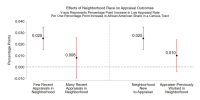

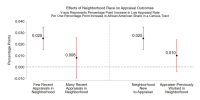

We study the impact of neighborhoods’ race composition on appraisers’ valuation decisions in home purchase appraisals. Controlling for many appraisal inputs, including the appraiser themselves, we find that low appraisals (below the contract price) are at least 23 percent more likely in majority African American neighborhoods relative to neighborhoods with no African American residents. Instrumental variable estimates, based on historical race shares, indicate an impact of at least 13 percent. However, this effect dissipates when appraisers work in neighborhoods in which they have appraised before or in which many appraisals were recently completed, facts consistent with information based models of discrimination.

www.fhfa.gov

www.fhfa.gov

We study the impact of neighborhoods’ race composition on appraisers’ valuation decisions in home purchase appraisals. Controlling for many appraisal inputs, including the appraiser themselves, we find that low appraisals (below the contract price) are at least 23 percent more likely in majority African American neighborhoods relative to neighborhoods with no African American residents. Instrumental variable estimates, based on historical race shares, indicate an impact of at least 13 percent. However, this effect dissipates when appraisers work in neighborhoods in which they have appraised before or in which many appraisals were recently completed, facts consistent with information based models of discrimination.

Working Paper 24-06: Home Purchase Appraisals in Minority Neighborhoods | FEDERAL HOUSING FINANCE AGENCY

Author: Daniel Grodzicki, Sean Cannon, Christopher W. Davis, Ken Lam