-

Welcome to AppraisersForum.com, the premier online

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Appraiser Shortage Myth Part 43

- Thread starter Michigan CG

- Start date

- Status

- Not open for further replies.

Jonathan Miller

Freshman Member

- Joined

- Jul 22, 2008

- Professional Status

- Certified General Appraiser

- State

- New York

How many fewer mortgages are taken now than in 2007?

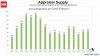

This chart is from the followup Webinar I asked HousingWire to provide after the Coester disaster. The chart below was shared. It is dishonest to look at licensing trends from the peak of the bubble without context which has been the false narrative for the past several years. Because credit conditions have not normalized since Lehman and despite record low rates, mortgage volume has fallen sharply since the housing bubble peak. This chart gets it right. It shows that the ratio of appraisers to originations is about half the housing bubble peak. Even though appraiser licenses have fallen, mortgage volume has fallen much faster. This is why the "appraisal shortage" narrative that was pushed by AMCs, large appraisal companies and AI National was designed to push for expanded use of AVMs and other automated tools.

TRESinc

Elite Member

- Joined

- Dec 1, 2011

- Professional Status

- Licensed Appraiser

- State

- Ohio

'try again, post the # where I said Wells Fargo is an AMC.

Going to rain in Georgia.

.

confused much? can't remember what thread you are posting misinformation in?

but since you want to cross-reference threads on here no, you did not say wells fargo was an AMC. that was a mistake on my part. so with that out of the way where is your proof that an appraiser who works for wells fargo is going to have their identity stolen as a result of signing up for their panel?

Meandering

Elite Member

- Joined

- Feb 26, 2006

- Professional Status

- Real Estate Agent or Broker

- State

- Pennsylvania

confused much? can't remember what thread you are posting misinformation in?

but since you want to cross-reference threads on here no, you did not say wells fargo was an AMC. that was a mistake on my part. so with that out of the way where is your proof that an appraiser who works for wells fargo is going to have their identity stolen as a result of signing up for their panel?

And you are supplying the above as evidence to what you alleged?

Are you drinking the city water?

Stand back coffee,

This is ANOTHER job for alcohol!

.

Eli

Elite Member

- Joined

- May 12, 2007

- Professional Status

- Certified General Appraiser

- State

- Tennessee

This chart is from the followup Webinar I asked HousingWire to provide after the Coester disaster. The chart below was shared. It is dishonest to look at licensing trends from the peak of the bubble without context which has been the false narrative for the past several years. Because credit conditions have not normalized since Lehman and despite record low rates, mortgage volume has fallen sharply since the housing bubble peak. This chart gets it right. It shows that the ratio of appraisers to originations is about half the housing bubble peak. Even though appraiser licenses have fallen, mortgage volume has fallen much faster. This is why the "appraisal shortage" narrative that was pushed by AMCs, large appraisal companies and AI National was designed to push for expanded use of AVMs and other automated tools.

View attachment 32985

Yes. Let's not take it personal. It's business in the public trust. Cough, cough!

- Joined

- Mar 30, 2005

- Professional Status

- Certified General Appraiser

- State

- New York

This chart is from the followup Webinar I asked HousingWire to provide after the Coester disaster. The chart below was shared. It is dishonest to look at licensing trends from the peak of the bubble without context which has been the false narrative for the past several years. Because credit conditions have not normalized since Lehman and despite record low rates, mortgage volume has fallen sharply since the housing bubble peak. This chart gets it right. It shows that the ratio of appraisers to originations is about half the housing bubble peak. Even though appraiser licenses have fallen, mortgage volume has fallen much faster. This is why the "appraisal shortage" narrative that was pushed by AMCs, large appraisal companies and AI National was designed to push for expanded use of AVMs and other automated tools.

That chart is interesting. I remember becoming concerned about market conditions in 2000 because certain indicators were getting out of whack, one of those being income to median-home-price ratios. I if remember correctly, in 2001/2000 they started tinkering with interest rates, and haven't stopped since. So that chart may indicate that the "normal" annual originations per license credential should be some inbetween the 2000-2001 numbers based on numbers alone. All factors considered, it would probably be less, because it could get ugly if rates were allowed to float to market levels (no government influence...which of course won't happen in the foreseeable future).

- Status

- Not open for further replies.