Mejappz

Elite Member

- Joined

- Dec 16, 2005

- Professional Status

- Certified Residential Appraiser

- State

- Florida

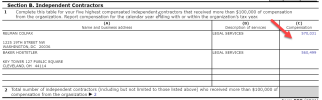

So The Appraisal Foundation paid Relman Colfax, a shakedown down firm deeply embedded in the swamp, $570,000 to assist in working with the current USPAP. You can not make this stuff up. The lack of accountability and corruption at TAF and the ASC is astonishing. On a side note, Dave Bunton gave himself a raise for 2022.

*** FOR IMMEDIATE RELEASE ***

GOFUNDME CAMPAIGN COULD RID HOME VALUATIONS OF DEI

INTIMIDATION

VENTURA, Calif. (Feb. 9, 2024) – Shane Lanham is an independent real estate

appraiser based in Parkville, Maryland. He’s being sued by two ethnic-studies

professors at Johns Hopkins University, backed by an opportunistic law firm, for

purportedly concluding a “low value” of the professors’ home due to the

couple’s race. Lanham is countersuing the pair for defamation after being

labeled a racist. He’s now seeking help from the public via a GoFundMe

campaign to keep the fight going.

In August 2022, the Washington, D.C.-based activist law firm Relman Colfax

filed a lawsuit in the U.S. District Court for the District of Maryland against

Lanham, the real estate appraisal company 20/20 Valuations, LLC, and

residential mortgage lender loanDepot.com, LLC, on behalf of college

professors Nathan Connolly and Shani Mott, alleging racial discrimination in a

home appraisal. The appraiser is white, and the property owners are black.

The couple, who are both black-studies professors at Johns Hopkins University,

allege Lanham violated the federal Fair Housing Act, the Equal Credit

Opportunity Act, the Civil Rights Act of 1866, and Maryland fair housing laws.

They seek damages, injunctive relief and declaratory relief. Lanham says he

was just doing his job as an appraiser.

Sometimes appraisals result in value opinions that torpedo a sale or

refinancing, or force parties to renegotiate. It’s the system working. What’s at

issue, believe observers, is appraiser independence and the freedom of a

financial analyst to speak an opinion without the risk of being harassed in the

courts by a disgruntled borrower with big-money backing. The nation’s $12

trillion mortgage market depends on the nation’s 80,000 appraisers being able

to render independent value opinions of the collateral.

Johns Hopkins University has been a hotbed of divisive racial politics as of late.

It’s a surprise to few that the plaintiffs are affiliated with Hopkins. Last month, its

medical school’s Office of Diversity, Inclusion, and Health Equity (DEI) issued a

toxic “privilege” list that made sweeping and offensive generalities about people

based largely on their race. It caused a backlash that resulted in a retraction

and an apology by the medical school’s dean.

Relman Colfax, representing the Hopkins professors, touts itself as a national

civil rights law firm. It clearly prospects for promising veins of discrimination –

real and imagined – and works the coalface for payouts from bled-out mom-

and-pops and cowardly public agencies and corporations.

A murky Beltway nonprofit known as the Appraisal Foundation, according to its

2022 IRS Form 990, paid over $500,000 to Relman Colfax in the year covered

by the filing. The nonprofit has received tens of millions of dollars in grants from

an obscure federal entity known by the tortuous name the Appraisal

Subcommittee of the Federal Financial Institutions Examination Council. The

tiny federal entity, in turn, receives its budget, which has become all but a slush

fund, outside the congressional appropriations process. It commandeers state

appraiser licensing agencies for its annual spending money. The states simply

add the costs as pass-throughs to the licensees’ renewal fees. The lack of

accountability has been a recipe for corruption.

Attorney John Relman of the law firm was vocal in 2022 in perpetuating the

trope that a state-licensed appraiser would value a property based on the race

of the borrower. A flawed Brookings Institution study in 2018 served as the

basis for such accusations, but it has since been refuted by researchers

Edward Pinto and Tobias Peter at the AEI Housing Center. The discredited

Brookings findings were found to have ignored key socio-economic factors. No

case alleging appraiser discrimination has ever been adjudicated in a court of

law.

Lanham is confident in his opinion of the home’s value. He says he is

committed to fighting the allegation in court and going after his accusers for the

harm they have caused to his professional reputation. He said he has engaged

a consultant with significant experience in these types of cases.

“Through an insurance policy I carry,” said Lanham, “I have limited funds, only

$100,000, to cover the costs of the lawsuit through investigation, discovery,

motions, and trial. However, my understanding is that the $100,000 amount will

not be enough to take this case through trial both defending myself from the

false allegations and prosecuting the defamation case. My goal is to raise

$50,000 through [a] GoFundMe to cover the lawsuit costs that my insurance

policy will not pay, and that I cannot personally afford.”

Any money not used, said Lanham, will be donated to The National Association

of Appraisers to help fund scholarships for those trying to enter the field but

cannot afford the costs associated with doing so.

# # #

You can contribute to Lanham’s legal fund by going to his GoFundMe page

here.

# # #

Jeremy Bagott is a real estate appraiser and former newspaperman. His most

recent book, “The Ichthyologist’s Guide to the Subprime Meltdown,” is a

concise almanac that distills the cataclysmic financial crisis of 2007-2008 to its

essence. This pithy guide to the upheaval includes essays, chronologies,

roundups and key lists, weaving together the stories of the politics-infused

Freddie and Fannie; the doomed Wall Street investment banks Lehman and

Bear Stearns; the dereliction of duty by the Big Three credit-rating services; the

mayhem caused by the shadowy nonbank lenders; and the massive

government bailouts. It provides a rapid-fire succession of “ah-hah” moments

as it lays out the meltdown, convulsion by convulsion.

# # #

*** FOR IMMEDIATE RELEASE ***

GOFUNDME CAMPAIGN COULD RID HOME VALUATIONS OF DEI

INTIMIDATION

VENTURA, Calif. (Feb. 9, 2024) – Shane Lanham is an independent real estate

appraiser based in Parkville, Maryland. He’s being sued by two ethnic-studies

professors at Johns Hopkins University, backed by an opportunistic law firm, for

purportedly concluding a “low value” of the professors’ home due to the

couple’s race. Lanham is countersuing the pair for defamation after being

labeled a racist. He’s now seeking help from the public via a GoFundMe

campaign to keep the fight going.

In August 2022, the Washington, D.C.-based activist law firm Relman Colfax

filed a lawsuit in the U.S. District Court for the District of Maryland against

Lanham, the real estate appraisal company 20/20 Valuations, LLC, and

residential mortgage lender loanDepot.com, LLC, on behalf of college

professors Nathan Connolly and Shani Mott, alleging racial discrimination in a

home appraisal. The appraiser is white, and the property owners are black.

The couple, who are both black-studies professors at Johns Hopkins University,

allege Lanham violated the federal Fair Housing Act, the Equal Credit

Opportunity Act, the Civil Rights Act of 1866, and Maryland fair housing laws.

They seek damages, injunctive relief and declaratory relief. Lanham says he

was just doing his job as an appraiser.

Sometimes appraisals result in value opinions that torpedo a sale or

refinancing, or force parties to renegotiate. It’s the system working. What’s at

issue, believe observers, is appraiser independence and the freedom of a

financial analyst to speak an opinion without the risk of being harassed in the

courts by a disgruntled borrower with big-money backing. The nation’s $12

trillion mortgage market depends on the nation’s 80,000 appraisers being able

to render independent value opinions of the collateral.

Johns Hopkins University has been a hotbed of divisive racial politics as of late.

It’s a surprise to few that the plaintiffs are affiliated with Hopkins. Last month, its

medical school’s Office of Diversity, Inclusion, and Health Equity (DEI) issued a

toxic “privilege” list that made sweeping and offensive generalities about people

based largely on their race. It caused a backlash that resulted in a retraction

and an apology by the medical school’s dean.

Relman Colfax, representing the Hopkins professors, touts itself as a national

civil rights law firm. It clearly prospects for promising veins of discrimination –

real and imagined – and works the coalface for payouts from bled-out mom-

and-pops and cowardly public agencies and corporations.

A murky Beltway nonprofit known as the Appraisal Foundation, according to its

2022 IRS Form 990, paid over $500,000 to Relman Colfax in the year covered

by the filing. The nonprofit has received tens of millions of dollars in grants from

an obscure federal entity known by the tortuous name the Appraisal

Subcommittee of the Federal Financial Institutions Examination Council. The

tiny federal entity, in turn, receives its budget, which has become all but a slush

fund, outside the congressional appropriations process. It commandeers state

appraiser licensing agencies for its annual spending money. The states simply

add the costs as pass-throughs to the licensees’ renewal fees. The lack of

accountability has been a recipe for corruption.

Attorney John Relman of the law firm was vocal in 2022 in perpetuating the

trope that a state-licensed appraiser would value a property based on the race

of the borrower. A flawed Brookings Institution study in 2018 served as the

basis for such accusations, but it has since been refuted by researchers

Edward Pinto and Tobias Peter at the AEI Housing Center. The discredited

Brookings findings were found to have ignored key socio-economic factors. No

case alleging appraiser discrimination has ever been adjudicated in a court of

law.

Lanham is confident in his opinion of the home’s value. He says he is

committed to fighting the allegation in court and going after his accusers for the

harm they have caused to his professional reputation. He said he has engaged

a consultant with significant experience in these types of cases.

“Through an insurance policy I carry,” said Lanham, “I have limited funds, only

$100,000, to cover the costs of the lawsuit through investigation, discovery,

motions, and trial. However, my understanding is that the $100,000 amount will

not be enough to take this case through trial both defending myself from the

false allegations and prosecuting the defamation case. My goal is to raise

$50,000 through [a] GoFundMe to cover the lawsuit costs that my insurance

policy will not pay, and that I cannot personally afford.”

Any money not used, said Lanham, will be donated to The National Association

of Appraisers to help fund scholarships for those trying to enter the field but

cannot afford the costs associated with doing so.

# # #

You can contribute to Lanham’s legal fund by going to his GoFundMe page

here.

# # #

Jeremy Bagott is a real estate appraiser and former newspaperman. His most

recent book, “The Ichthyologist’s Guide to the Subprime Meltdown,” is a

concise almanac that distills the cataclysmic financial crisis of 2007-2008 to its

essence. This pithy guide to the upheaval includes essays, chronologies,

roundups and key lists, weaving together the stories of the politics-infused

Freddie and Fannie; the doomed Wall Street investment banks Lehman and

Bear Stearns; the dereliction of duty by the Big Three credit-rating services; the

mayhem caused by the shadowy nonbank lenders; and the massive

government bailouts. It provides a rapid-fire succession of “ah-hah” moments

as it lays out the meltdown, convulsion by convulsion.

# # #