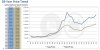

This chart shows delinquency rates for the largest 100 banks (blue line) and for the remaining 4,788 banks (red line):

But among the remaining 4,788 banks, the charge-off rate spiked to 7.99%, the highest since Q2 2010. The rate among smaller banks had peaked during the Financial Crisis in Q4 2009 at 8.78%:

In the overall scheme of things, these 4,788 smaller banks hold only a small portion of all banking assets, including credit card balances. However, these are the good times with unemployment below 4% and a growing economy.

What happens when the economy turns south?