Fernando

Elite Member

- Joined

- Nov 7, 2016

- Professional Status

- Certified Residential Appraiser

- State

- California

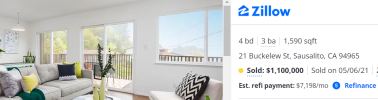

The comps are out there and the public will ask why you didn't considered the higher comps.That was a dumb thing for you to say. Did you look at the details of that transaction? I did. That's why I know and you don't.

Unlike you, I look at all the comps which a knowledgeable appraiser would consider even if outside neighborhood for such a difficult assignment.